Mazda 2016 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2016 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

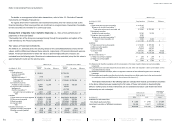

Millions of yen

Thousands of

U.S. dollars

For the years ended March 31 2016 2015 2016

Movements in plan assets:

Balance at beginning of year ¥254,906

¥233,516

$2,255,805

Expected return on plan assets 4,751

4,579

42,044

Actuarial gains/(losses) (5,110)

13,602

(45,221)

Contributions paid by the employer 13,335

12,961

118,009

Benefits paid (11,951)

(12,515)

(105,761)

Other (1,543)

2,763

(13,655)

Balance at end of year ¥254,388

¥254,906

$2,251,221

The reconciliation of the retirement benefit obligations and plan assets to the liability and asset

for retirement benefits recognized in the consolidated balance sheets of March 31, 2016 and 2015

were as follows:

Millions of yen

Thousands of

U.S. dollars

As of March 31 2016 2015 2016

Funded retirement benefit obligations ¥ 317,775

¥ 294,389

$ 2,812,168

Plan assets (254,388)

(254,906)

(2,251,221)

Subtotal 63,387

39,483

560,947

Unfunded retirement benefit obligations 19,642

19,863

173,823

Total net liability (asset) for retirement benefits

recognized in consolidated balance sheets 83,029

59,346

734,770

Liability for retirement benefits 85,916

62,669

760,319

Asset for retirement benefits (2,887)

(3,323)

(25,549)

Total net liability (asset) for retirement benefits

recognized in consolidated balance sheets ¥ 83,029

¥ 59,346

$ 734,770

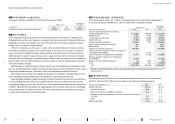

The profits and losses related to retirement benefits for the years ended March 31, 2016 and

2015 were as follows:

Millions of yen

Thousands of

U.S. dollars

For the years ended March 31 2016 2015 2016

Service cost ¥11,126

¥ 9,900

$ 98,460

Interest cost 3,864

4,611

34,195

Expected return on plan assets (4,751)

(4,579)

(42,044)

Net actuarial loss amortization 3,943

6,429

34,894

Past service costs amortization (3,107)

(3,132)

(27,496)

Other (31)

3,358

(274)

Severance and retirement benefit expenses ¥11,044

¥16,587

$ 97,735

Note: For the years ended March 31, 2016 and 2015, accrued pension costs related to defined contribution plans were charged to income

as ¥3,661 million ($32,398 thousand) and ¥3,298 million, respectively. This cost is not included in the above.

The breakdown of items of adjustments for retirement benefit (before tax) recognized in other

comprehensive income for the years ended March 31, 2016 and 2015 were as follows:

Millions of yen

Thousands of

U.S. dollars

For the years ended March 31 2016 2015 2016

Past service costs ¥ (3,061)

¥(3,132)

$ (27,088)

Actuarial differences (26,941)

6,987

(238,416)

Other (3)

(2)

(27)

Total ¥(30,005)

¥ 3,853

$(265,531)

The breakdown of items of accumulated adjustments for retirement benefits (before tax) recognized

in accumulated other comprehensive income as of March 31, 2016 and 2015 were as follows:

Millions of yen

Thousands of

U.S. dollars

As of March 31 2016 2015 2016

Past service costs that are yet to be recognized ¥ 8,035

¥ 11,096

$ 71,106

Actuarial gains and losses that are yet to

be recognized (42,430)

(15,489)

(375,487)

Other 5

8

45

Total ¥(34,390)

¥ (4,385)

$(304,336)

The breakdown of plan assets by major category as of March 31, 2016 and 2015 were

as follows:

As of March 31 2016 2015

Bonds 43%

41%

Equity securities 25%

29%

General accounts of the life insurance companies 17%

17%

Other 15%

13%

Total 100%

100%

The major items of actuarial assumptions for the years ended March 31, 2016 and 2015 were

as follows:

For the years ended March 31 2016 2015

Discount rate Primarily 0.7%

Primarily 1.1%

Long-term expected rate of return Primarily 1.5%

Primarily 1.5%

Notes to Consolidated Financial Statements

MAZDA ANNUAL REPORT 2016

Financial Section

Message from

Management

Review of Operations

Drivers of Value Creation

Foundations Underpinning

Sustainable Growth

Contents