Macy's 2008 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2008 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

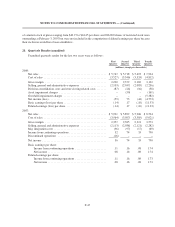

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

of common stock at prices ranging from $40.27 to $44.45 per share and 286,000 shares of restricted stock were

outstanding at February 3, 2007 but were not included in the computation of diluted earnings per share because

their inclusion would have been antidilutive.

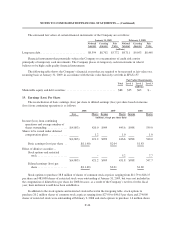

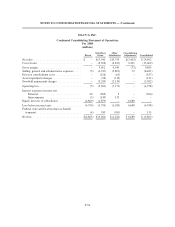

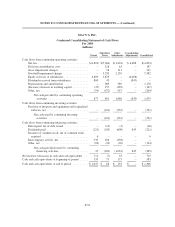

20. Quarterly Results (unaudited)

Unaudited quarterly results for the last two years were as follows:

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

(millions, except per share data)

2008:

Net sales ............................................... $5,747 $ 5,718 $ 5,493 $ 7,934

Cost of sales ............................................ (3,527) (3,346) (3,324) (4,812)

Gross margin ........................................... 2,220 2,372 2,169 3,122

Selling, general and administrative expenses .................. (2,103) (2,037) (2,085) (2,256)

Division consolidation costs and store closing related costs ....... (87) (26) (16) (58)

Asset impairment charges ................................. – (50) – (161)

Goodwill impairment charges ..............................–––(5,382)

Net income (loss) ........................................ (59) 73 (44) (4,773)

Basic earnings (loss) per share .............................. (.14) .17 (.10) (11.33)

Diluted earnings (loss) per share ............................ (.14) .17 (.10) (11.33)

2007:

Net sales ............................................... $5,921 $ 5,892 $ 5,906 $ 8,594

Cost of sales ............................................ (3,564) (3,507) (3,585) (5,021)

Gross margin ........................................... 2,357 2,385 2,321 3,573

Selling, general and administrative expenses .................. (2,113) (2,038) (2,121) (2,282)

May integration costs ..................................... (36) (97) (17) (69)

Income from continuing operations .......................... 52 74 33 750

Discontinued operations .................................. (16) – – –

Net income ............................................. 36 74 33 750

Basic earnings per share:

Income from continuing operations ...................... .11 .16 .08 1.74

Net income ......................................... .08 .16 .08 1.74

Diluted earnings per share:

Income from continuing operations ...................... .11 .16 .08 1.73

Net income ......................................... .08 .16 .08 1.73

F-47