Macy's 2008 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2008 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

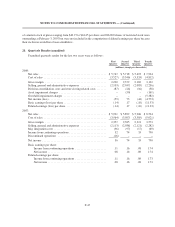

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

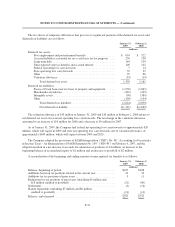

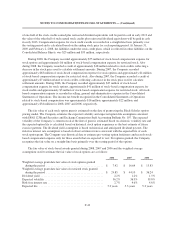

Net pension costs and other amounts recognized in other comprehensive income for the supplementary

retirement plan included the following actuarially determined components:

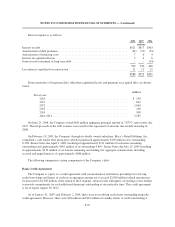

2008 2007 2006

(millions)

Net Periodic Pension Cost

Service cost ............................................................ $ 8 $ 7 $ 9

Interest cost ............................................................ 39 38 39

Amortization of net actuarial loss ........................................... – 1 8

Amortization of prior service credit .......................................... (2) (1) (1)

45 45 55

Other Changes in Plan Assets and Projected Benefit Obligation

Recognized in Other Comprehensive Income

Net actuarial gain ........................................................ (57) (27) –

Amortization of net actuarial loss ........................................... – (1) –

Amortization of prior service credit .......................................... 2 1 –

(55) (27) –

Total recognized in net periodic pension cost and other comprehensive income ........... $(10) $ 18 $55

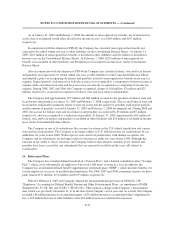

The estimated net actuarial gain and prior service credit for the supplementary retirement plan that will be

amortized from accumulated other comprehensive income into net periodic benefit cost during 2009 are $0

million and $(1) million, respectively.

As permitted under SFAS No. 87, “Employers’ Accounting for Pensions,” the amortization of any prior

service cost is determined using a straight-line amortization of the cost over the average remaining service period

of employees expected to receive benefits under the plans.

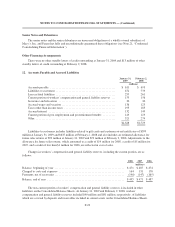

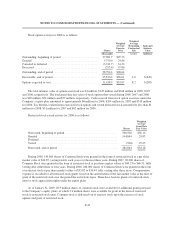

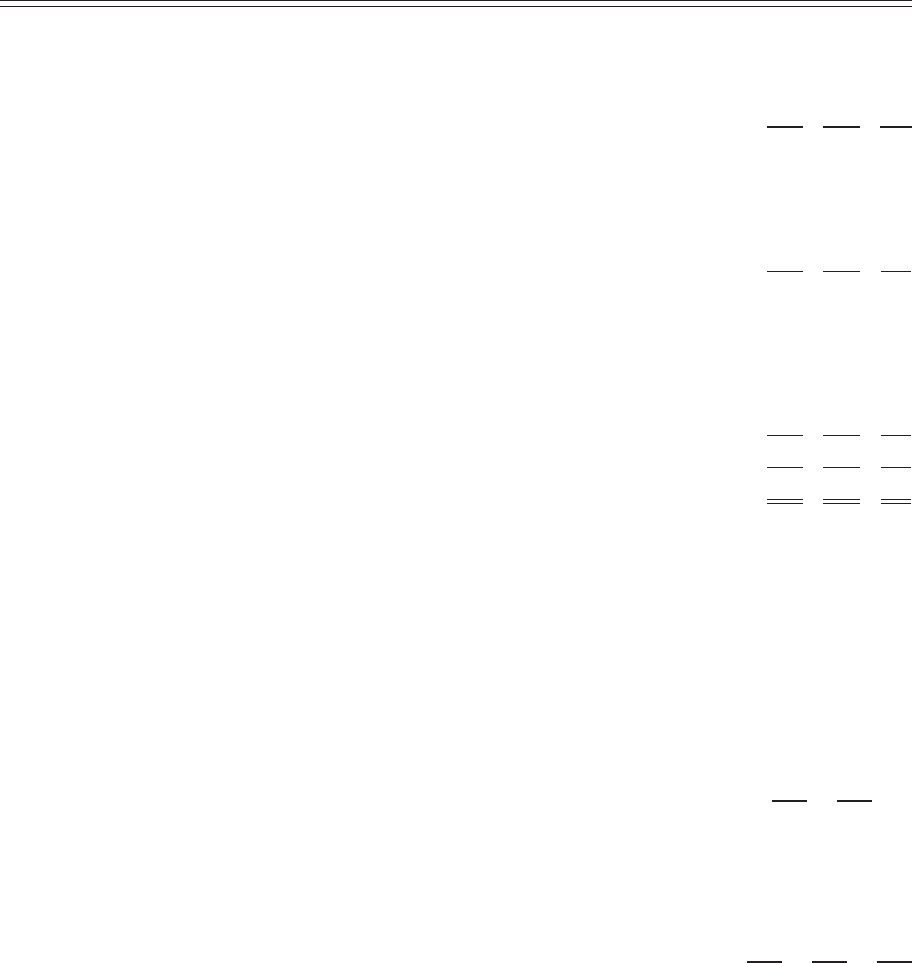

The following weighted average assumptions were used to determine benefit obligations for the

supplementary retirement plan at January 31, 2009 and February 2, 2008:

2008 2007

Discount rate ........................................................... 7.45% 6.25%

Rate of compensation increases ............................................ 7.20% 7.20%

The following weighted average assumptions were used to determine net pension costs for the

supplementary retirement plan:

2008 2007 2006

Discount rate prior to plan merger or change in measurement date ................... – 5.85% 5.70%

Discount rate subsequent to plan merger or change in measurement date .............. 6.25% 5.95% 6.30%

Rate of compensation increases ............................................... 7.20% 7.20% 7.20%

The supplementary retirement plan’s assumptions are evaluated annually and updated as necessary. The

discount rate used to determine the present value of the Company’s future supplementary retirement plan

obligations is based on a yield curve constructed from a portfolio of high quality corporate debt securities with

various maturities. Each year’s expected future benefit payments are discounted to their present value at the

appropriate yield curve rate, thereby generating the overall discount rate for supplementary retirement plan

obligations.

F-37