Macy's 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

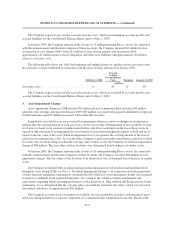

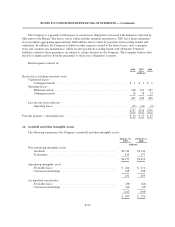

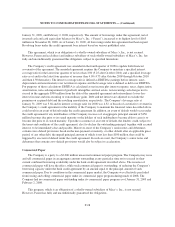

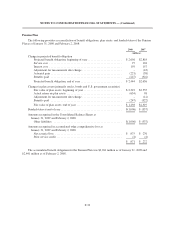

Interest expense is as follows:

2008 2007 2006

(millions)

Interest on debt ............................................................ $621 $617 $563

Amortization of debt premium ................................................ (34) (37) (53)

Amortization of financing costs ...............................................764

Interest on capitalized leases ..................................................546

Gain on early retirement of long-term debt ....................................... – – (54)

599 590 466

Less interest capitalized on construction ......................................... 11 11 15

$588 $579 $451

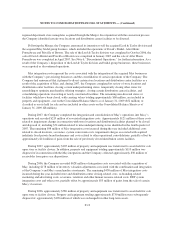

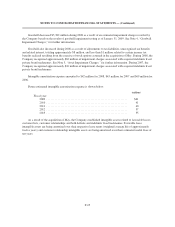

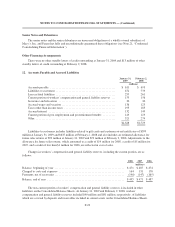

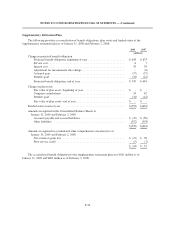

Future maturities of long-term debt, other than capitalized leases and premium on acquired debt, are shown

below:

(millions)

Fiscal year:

2010 ......................................................... $ 238

2011 ......................................................... 662

2012 ......................................................... 1,663

2013 ......................................................... 138

2014 ......................................................... 508

After 2014 ..................................................... 5,185

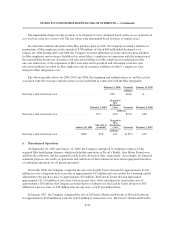

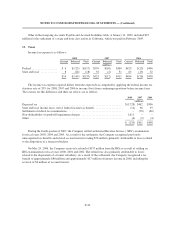

On June 23, 2008, the Company issued $650 million aggregate principal amount of 7.875% senior notes due

2015. The net proceeds of the debt issuance were used for the repayment of amounts due on debt maturing in

2008.

On February 10, 2009, the Company, through its wholly owned subsidiary, Macy’s Retail Holdings, Inc.,

completed a cash tender offer pursuant to which it purchased approximately $199 million of its outstanding

6.30% Senior Notes due April 1, 2009 (resulting in approximately $151 million of such notes remaining

outstanding) and approximately $481 million of its outstanding 4.80% Senior Notes due July 15, 2009 (resulting

in approximately $119 million of such notes remaining outstanding) for aggregate consideration, including

accrued and unpaid interest, of approximately $686 million.

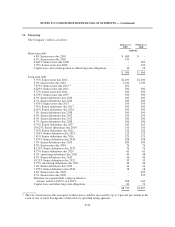

The following summarizes certain components of the Company’s debt:

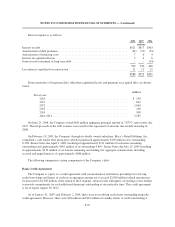

Bank Credit Agreement

The Company is a party to a credit agreement with certain financial institutions providing for revolving

credit borrowings and letters of credit in an aggregate amount not to exceed $2,000 million (which amount may

be increased to $2,500 million at the option of the Company, subject to the willingness of existing or new lenders

to provide commitments for such additional financing) outstanding at any particular time. This credit agreement

is set to expire August 30, 2012.

As of January 31, 2009, and February 2, 2008, there were no revolving credit loans outstanding under the

credit agreement. However, there were $48 million and $32 million of standby letters of credit outstanding at

F-27