Macy's 2008 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2008 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

term, an additional renewal term of three years. The Program Agreement provides for, among other things, (i) the

ownership by Citibank of the accounts purchased by Citibank, (ii) the ownership by Citibank of new accounts

opened by the Company’s customers, (iii) the provision of credit by Citibank to the holders of the credit cards

associated with the foregoing accounts, (iv) the servicing of the foregoing accounts, and (v) the allocation

between Citibank and the Company of the economic benefits and burdens associated with the foregoing and

other aspects of the alliance.

Pursuant to the Program Agreement, the Company continues to provide certain servicing functions related to

the accounts and related receivables owned by Citibank and receives compensation from Citibank for these

services. The amounts earned under the Program Agreement related to the servicing functions are deemed

adequate compensation and, accordingly, no servicing asset or liability has been recorded on the Consolidated

Balance Sheets.

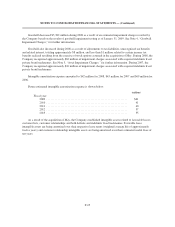

Amounts received under the Program Agreement were $594 million for 2008, $661 million for 2007, and

$538 million for 2006, and are treated as reductions of selling, general and administrative expenses on the

Consolidated Statements of Operations. The Company’s earnings from credit operations, net of servicing

expenses, were $372 million for 2008, $450 million for 2007, and $526 million for 2006.

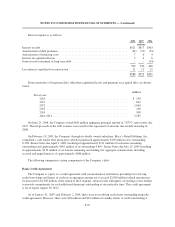

On May 1, 2006, the Company terminated the Company’s credit card program agreement with GE Capital

Consumer Card Co. (“GE Bank”) and purchased all of the “Macy’s” credit card accounts owned by GE Bank,

together with related receivables balances (the “GE/Macy’s Credit Assets”), as of April 30, 2006. Also on May 1,

2006, the Company sold the GE/Macy’s Credit Assets to Citibank, resulting in a pre-tax gain of approximately

$179 million. The net proceeds of approximately $180 million were used to repay short-term borrowings

associated with the acquisition of May.

On May 22, 2006, the Company sold a portion of the acquired May credit card accounts and related

receivables to Citibank, resulting in a pre-tax gain of approximately $5 million. The net proceeds of

approximately $800 million were primarily used to repay short-term borrowings associated with the acquisition

of May.

On July 17, 2006, the Company sold the remaining portion of the acquired May credit card accounts and

related receivables to Citibank, resulting in a pre-tax gain of approximately $7 million. The net proceeds of

approximately $1,100 million were used for general corporate purposes.

Sales through the Company’s proprietary credit plans were $1,385 million for 2006. Finance charge income

related to proprietary credit card holders amounted to $106 million for 2006.

The credit plans relating to certain operations of the Company were owned by GE Bank prior to April 30,

2006. However, the Company participated with GE Bank in the net operating results of such plans. Various

arrangements between the Company and GE Bank were set forth in a credit card program agreement.

8. Inventories

Merchandise inventories were $4,769 million at January 31, 2009, compared to $5,060 million at

February 2, 2008. At these dates, the cost of inventories using the LIFO method approximated the cost of such

inventories using the FIFO method. The application of the LIFO method did not impact cost of sales for 2008,

2007 or 2006.

F-22