Macy's 2008 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2008 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

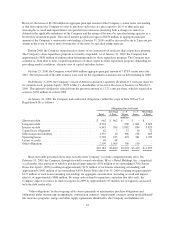

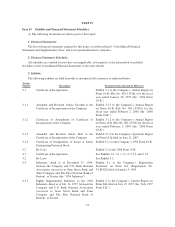

In accordance with the fair value hierarchy described above, the following table shows the fair value of the

Company’s financial assets and liabilities that are required to be measured at fair value on a recurring basis at

January 31, 2009:

Total

Fair Value Measurements

Level 1 Level 2 Level 3

(millions)

Marketable equity and debt securities .................................. $88 $25 $63 $–

In February 2008, the Financial Accounting Standards Board (“FASB”) issued FASB Staff Position

No. 157-2 (“FSP 157-2”) that permits a one-year deferral for the implementation of SFAS 157 with regard to

nonfinancial assets and liabilities that are not recognized or disclosed at fair value on a recurring basis (at least

annually). This deferral will impact the Company’s accounting for certain nonfinancial assets and liabilities

accounted for under SFAS No. 142, “Goodwill and Other Intangible Assets,” SFAS No. 144, “Accounting for the

Impairment or Disposal of Long-Lived Assets,” SFAS No. 143, “Accounting for Asset Retirement Obligations”

and SFAS No. 146, “Accounting for Costs Associated with Exit or Disposal Activities.” The Company had

elected this deferral and the full adoption of SFAS 157, effective February 1, 2009, is not expected to have a

material impact on the Company’s consolidated financial position, results of operations and cash flows.

SFAS No. 159 “The Fair Value Option for Financial Assets and Financial Liabilities,” (“SFAS 159”), which

provides companies with the option to report selected financial assets and liabilities at fair value, became effective

for the Company beginning February 3, 2008. The adoption of this statement did not and is not expected to have an

impact on the Company’s consolidated financial position, results of operations and cash flows.

In December 2007, the FASB issued SFAS No. 160 “Noncontrolling Interests in Consolidated Financial

Statements – an amendment of Accounting Research Bulletin (“ARB”) No. 51,” (“SFAS 160”). SFAS 160

establishes accounting and reporting standards for the noncontrolling interest in a subsidiary and for the

deconsolidation of a subsidiary. SFAS No. 160 is effective for fiscal years beginning after December 15, 2008.

The Company does not anticipate the adoption of this statement will have a material impact on the Company’s

consolidated financial position, results of operations or cash flows.

Also in December 2007, the FASB issued SFAS No. 141 (revised 2007), “Business Combinations,” (“SFAS

141R”). SFAS 141R establishes principles and requirements for how the acquirer of a business recognizes and

measures in its financial statements the identifiable assets acquired, the liabilities assumed, and any

noncontrolling interest in the acquiree. The statement also provides guidance for recognizing and measuring the

goodwill acquired in the business combination and determines what information to disclose to enable users of the

financial statements to evaluate the nature and financial effects of the business combination. SFAS 141R is

effective for fiscal years beginning after December 15, 2008. The adoption of this statement will affect any future

acquisitions entered into by the Company, and beginning with fiscal 2009 the Company will no longer account

for adjustments to acquired tax liabilities and unrecognized tax benefits as increases or decreases to goodwill.

Effective February 1, 2009, such adjustments will be accounted for in income tax expense.

In March 2008, the FASB issued SFAS No. 161, “Disclosures About Derivative Instruments and Hedging

Activities – an amendment of FASB Statement No. 133,” (“SFAS 161”). SFAS 161 expands disclosure

requirements for derivative instruments and hedging activities. SFAS 161 is effective for fiscal years beginning

after November 15, 2008. The Company does not anticipate the adoption of this statement will have a material

impact on the Company’s consolidated financial position, results of operations or cash flows.

In May 2008, the FASB issued SFAS No. 162, “The Hierarchy of Generally Accepted Accounting Principles,”

(“SFAS 162”). SFAS 162 identifies the sources of accounting principles and the framework for selecting the

principles used in the preparation of financial statements of nongovernmental entities that are presented in

conformity with generally accepted accounting principles in the United States of America. SFAS 162 became

29