Macy's 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

of Boston businesses represented approximately $751 million of net assets, before income taxes. After

adjustment for a liability for a working capital adjustment to the purchase price and other items totaling

approximately $11 million, the Company recorded the loss on disposal of the David’s Bridal and Priscilla of

Boston businesses of $22 million on a pre-tax basis, or $18 million after income taxes, or $.03 per diluted share.

In April 2007, the Company completed the sale of its After Hours Formalwear business for approximately

$66 million in cash, net of $1 million of transaction costs. The After Hours Formalwear business represented

approximately $73 million of net assets. The Company recorded the loss on disposal of the After Hours

Formalwear business of $7 million on a pre-tax and after-tax basis, or $.01 per diluted share.

In connection with the sale of the David’s Bridal and Priscilla of Boston businesses, the Company agreed to

indemnify the buyer and related parties of the buyer for certain losses or liabilities incurred by the buyer or such

related parties with respect to (1) certain representations and warranties made to the buyer by the Company in

connection with the sale, (2) liabilities relating to the After Hours Formalwear business under certain

circumstances, and (3) certain pre-closing tax obligations. The representations and warranties in respect of which

the Company is subject to indemnification are generally limited to representations and warranties relating to the

capitalization of the entities that were sold, the Company’s ownership of the equity interests that were sold, the

enforceability of the agreement and certain employee benefits and tax matters. The indemnity for breaches of

most of these representations expired on March 31, 2008, with the exception of certain representations relating to

capitalization and the Company’s ownership interest, in respect of which the indemnity does not expire.

Indemnity obligations created in connection with the sales of businesses generally do not represent added

liabilities for the Company, but simply serve to protect the buyer from potential liabilities associated with

particular conditions. The Company records accruals for those pre-closing obligations that are considered

probable and estimable. Under FASB Interpretation No. 45, “Guarantor’s Accounting and Disclosure

Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of Others,” the Company is required

to record a liability for the fair value of the guarantees that are entered into subsequent to December 15, 2002.

The Company has not accrued any additional amounts as a result of the indemnity arrangements summarized

above as the Company believes the fair value of these arrangements is not material.

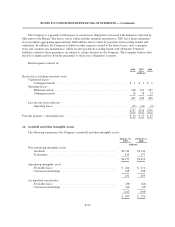

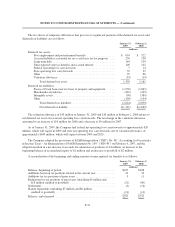

Discontinued operations included net sales of approximately $27 million for 2007 and approximately $1,741

million for 2006. No consolidated interest expense had been allocated to discontinued operations. For 2007, the

loss from discontinued operations, including the loss on disposal of the Company’s After Hours Formalwear

business, totaled $22 million before income taxes, with a related income tax benefit of $6 million. For 2006,

income from discontinued operations, net of the losses on disposal of the Lord & Taylor division and the David’s

Bridal and Priscilla of Boston businesses, totaled $17 million before income taxes, with a related income tax

expense of $10 million.

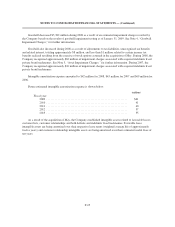

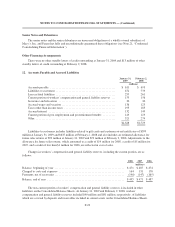

7. Receivables

Receivables were $439 million at January 31, 2009, compared to $463 million at February 2, 2008, and

consist primarily of receivables from third-party credit card companies, including amounts due under the

Program Agreement.

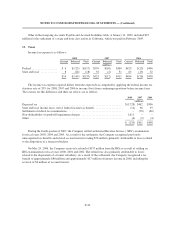

In connection with the sales of credit card accounts and related receivable balances, including the

transactions discussed below, the Company and Citibank entered into a long-term marketing and servicing

alliance pursuant to the terms of a Credit Card Program Agreement (the “Program Agreement”) with an initial

term of 10 years expiring on July 17, 2016 and, unless terminated by either party as of the expiration of the initial

F-21