Macy's 2008 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2008 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

However, the terms of $3,700 million in aggregate principal amount of the Company’s senior notes outstanding

at that date require the Company to offer to purchase such notes at a price equal to 101% of their principal

amount plus accrued and unpaid interest in specified circumstances involving both a change of control (as

defined in the applicable indenture) of the Company and the rating of the notes by specified rating agencies at a

level below investment grade. The rate of interest payable in respect of $650 million in aggregate principal

amount of the Company’s senior notes outstanding at January 31, 2009 could be increased by up to 2 percent per

annum in the event of one or more downgrades of the notes by specified rating agencies.

During 2008, the Company repurchased no shares of its common stock under its share repurchase program.

The Company’s share repurchase program is currently suspended. As of January 31, 2009, the Company had

approximately $850 million of authorization remaining under its share repurchase program. The Company may

continue or, from time to time, suspend repurchases of shares under its share repurchase program, depending on

prevailing market conditions, alternate uses of capital and other factors.

On June 23, 2008, the Company issued $650 million aggregate principal amount of 7.875% senior notes due

2015. The net proceeds of the debt issuance were used for the repayment of amounts due on debt maturing in 2008.

On February 2, 2009, the Company’s board of directors declared a quarterly dividend of 5 cents per share on

its common stock, payable April 1, 2009 to Macy’s shareholders of record at the close of business on March 13,

2009. This quarterly dividend is reduced from the previous amount of 13.25 cents per share, which is expected to

conserve $138 million of cash in 2009.

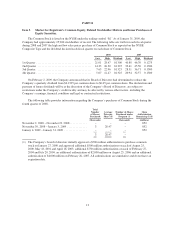

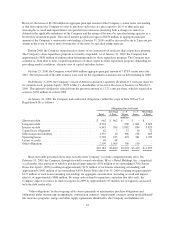

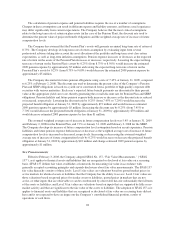

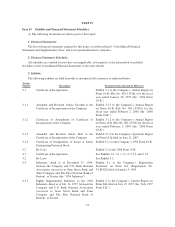

At January 31, 2009, the Company had contractual obligations (within the scope of Item 303(a)(5) of

Regulation S-K) as follows:

Obligations Due, by Period

Total

Less than

1 Year

1–3

Years

3–5

Years

More than

5 Years

(millions)

Short-term debt ..................................... $ 962 $ 962 $ – $ – $ –

Long-term debt ..................................... 8,394 – 900 1,801 5,693

Interest on debt ..................................... 6,345 589 1,082 854 3,820

Capital lease obligations .............................. 62 7 13 10 32

Other long-term liabilities ............................ 1,235 10 366 254 605

Operating leases .................................... 2,738 235 433 361 1,709

Letters of credit ..................................... 48 48 – – –

Other obligations ................................... 2,399 1,969 300 130 –

$22,183 $3,820 $3,094 $3,410 $11,859

Short-term debt presented above does not reflect the Company’s recently completed tender offer. On

February 10, 2009, the Company, through its wholly owned subsidiary, Macy’s Retail Holdings, Inc., completed

a cash tender offer pursuant to which it purchased approximately $199 million of its outstanding 6.30% Senior

Notes due April 1, 2009 (resulting in approximately $151 million of such notes remaining outstanding) and

approximately $481 million of its outstanding 4.80% Senior Notes due July 15, 2009 (resulting in approximately

$119 million of such notes remaining outstanding) for aggregate consideration, including accrued and unpaid

interest, of approximately $686 million. By using cash on hand to repurchase and retire this debt early, the

Company expects to reduce its interest expense in 2009 by approximately $7 million, net of expenses associated

with the debt tender offer.

“Other obligations” in the foregoing table consist primarily of merchandise purchase obligations and

obligations under outsourcing arrangements, construction contracts, employment contracts, group medical/dental/

life insurance programs, energy and other supply agreements identified by the Company and liabilities for

23