Macy's 2008 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2008 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Goodwill decreased $5,382 million during 2008 as a result of an estimated impairment charge recorded by

the Company based on the results of goodwill impairment testing as of January 31, 2009. See Note 4, “Goodwill

Impairment Charges,” for further information.

Goodwill also decreased during 2008 as a result of adjustments to tax liabilities, unrecognized tax benefits

and related interest, totaling approximately $8 million, and less than $1 million related to certain income tax

benefits realized resulting from the exercise of stock options assumed in the acquisition of May. During 2008, the

Company recognized approximately $63 million of impairment charges associated with acquired indefinite lived

private brand tradenames. See Note 3, “Asset Impairment Charges,” for further information. During 2007, the

Company recognized approximately $10 million of impairment charges associated with acquired indefinite lived

private brand tradenames.

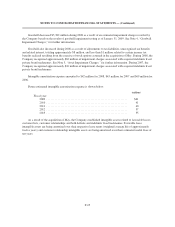

Intangible amortization expense amounted to $42 million for 2008, $43 million for 2007 and $69 million for

2006.

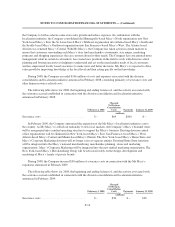

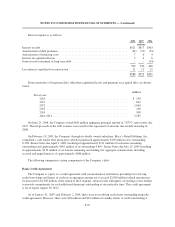

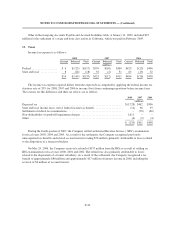

Future estimated intangible amortization expense is shown below:

(millions)

Fiscal year:

2009 ......................................................... $41

2010 ......................................................... 41

2011 ......................................................... 40

2012 ......................................................... 37

2013 ......................................................... 35

As a result of the acquisition of May, the Company established intangible assets related to favorable leases,

customer lists, customer relationships and both definite and indefinite lived tradenames. Favorable lease

intangible assets are being amortized over their respective lease terms (weighted average life of approximately

twelve years) and customer relationship intangible assets are being amortized over their estimated useful lives of

ten years.

F-25