Macy's 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

The impairment charges for the locations to be disposed of were calculated based on the excess of historical

cost over fair value less costs to sell. The fair values were determined based on prices of similar assets.

In connection with the allocation of the May purchase price in 2005, the Company recorded a liability for

termination of May employees in the amount of $358 million, of which $69 million had been paid as of

January 28, 2006. During 2007 and 2006, the Company recorded additional severance and relocation liabilities

for May employees and severance liabilities for certain Macy’s employees in connection with the integration of

the acquired May businesses. Severance and relocation liabilities for May employees recorded prior to the

one-year anniversary of the acquisition of May were allocated to goodwill and subsequent severance and

relocation liabilities recorded for May employees and all severance liabilities for Macy’s employees were

charged to May integration costs.

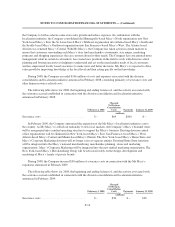

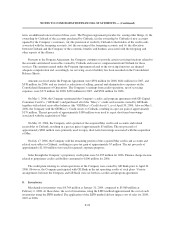

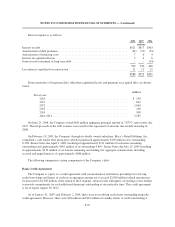

The following tables show, for 2008, 2007 and 2006, the beginning and ending balance of, and the activity

associated with, the severance and relocation accrual established in connection with the May integration:

February 2, 2008 Payments January 31, 2009

(millions)

Severance and relocation costs .............................. $30 $(30) $ –

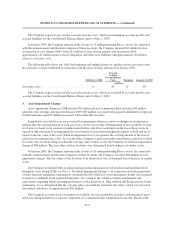

February 3, 2007

Charged to

May

Integration

Costs Payments February 2, 2008

(millions)

Severance and relocation costs .................... $73 $50 $(93) $30

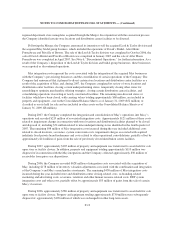

January 28, 2006

Allocated to

Goodwill

Charged to

May

Integration

Costs Payments February 3, 2007

(millions)

Severance and relocation costs .......... $289 $76 $35 $(327) $73

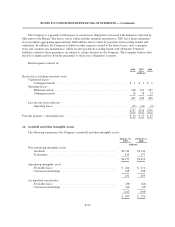

6. Discontinued Operations

On September 20, 2005 and January 12, 2006, the Company announced its intention to dispose of the

acquired May bridal group business, which included the operations of David’s Bridal, After Hours Formalwear

and Priscilla of Boston, and the acquired Lord & Taylor division of May, respectively. Accordingly, for financial

statement purposes, the results of operations and cash flows of these businesses have been segregated from those

of continuing operations for all periods presented.

In October 2006, the Company completed the sale of its Lord & Taylor division for approximately $1,047

million in cash, a long-term note receivable of approximately $17 million and a receivable for a working capital

adjustment to the purchase price of approximately $23 million. The Lord & Taylor division represented

approximately $1,130 million of net assets, before income taxes. After adjustment for transaction costs of

approximately $20 million, the Company recorded the loss on disposal of the Lord & Taylor division of $63

million on a pre-tax basis, or $38 million after income taxes, or $.07 per diluted share.

In January 2007, the Company completed the sale of its David’s Bridal and Priscilla of Boston businesses

for approximately $740 million in cash, net of $10 million of transaction costs. The David’s Bridal and Priscilla

F-20