Macy's 2008 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2008 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

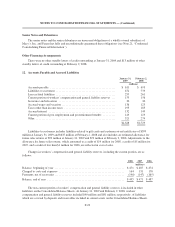

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Other in the foregoing Accounts Payable and Accrued Liabilities table, at January 31, 2009, included $25

million for the settlement of a wage and hour class action in California, which was paid in February 2009.

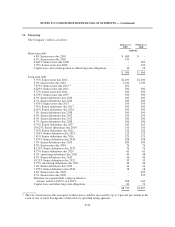

13. Taxes

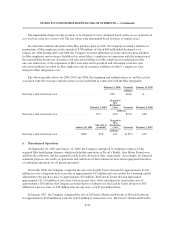

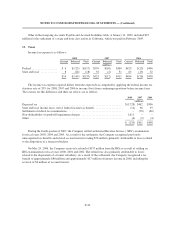

Income tax expense is as follows:

2008 2007 2006

Current Deferred Total Current Deferred Total Current Deferred Total

(millions)

Federal .................. $ 6 $(123) $(117) $370 $(10) $360 $429 $(23) $406

State and local ............ 8 (26) (18) 53 (2) 51 65 (13) 52

$14 $(149) $(135) $423 $(12) $411 $494 $(36) $458

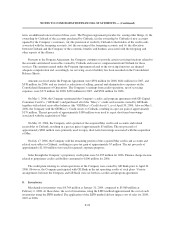

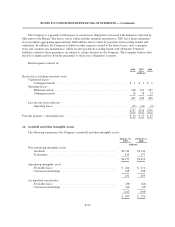

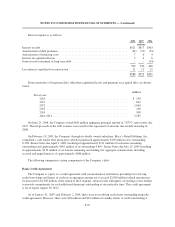

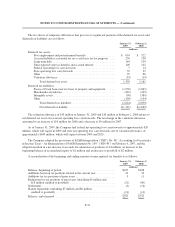

The income tax expense reported differs from the expected tax computed by applying the federal income tax

statutory rate of 35% for 2008, 2007 and 2006 to income (loss) from continuing operations before income taxes.

The reasons for this difference and their tax effects are as follows:

2008 2007 2006

(millions)

Expected tax ........................................................... $(1,728) $462 $506

State and local income taxes, net of federal income tax benefit .................... (12) 36 35

Settlement of federal tax examinations ....................................... – (78) (80)

Non-deductibility of goodwill impairment charges ............................. 1,611 – –

Other ................................................................. (6) (9) (3)

$ (135) $411 $458

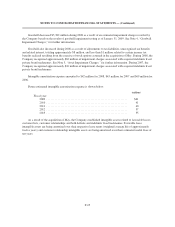

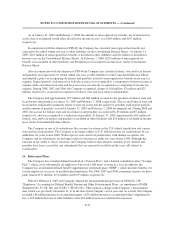

During the fourth quarter of 2007, the Company settled an Internal Revenue Service (“IRS”) examination

for fiscal years 2003, 2004 and 2005. As a result of the settlement, the Company recognized previously

unrecognized tax benefits and related accrued interest totaling $78 million, primarily attributable to losses related

to the disposition of a former subsidiary.

On May 24, 2006, the Company received a refund of $155 million from the IRS as a result of settling an

IRS examination for fiscal years 2000, 2001 and 2002. The refund was also primarily attributable to losses

related to the disposition of a former subsidiary. As a result of the settlement, the Company recognized a tax

benefit of approximately $80 million and approximately $17 million of interest income in 2006, including the

reversal of $6 million of accrued interest.

F-30