Macy's 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

The Company is a guarantor with respect to certain lease obligations associated with businesses divested by

May prior to the Merger. The leases, one of which includes potential extensions to 2087, have future minimum

lease payments aggregating approximately $666 million and are offset by payments from existing tenants and

subtenants. In addition, the Company is liable for other expenses related to the above leases, such as property

taxes and common area maintenance, which are also payable by existing tenants and subtenants. Potential

liabilities related to these guarantees are subject to certain defenses by the Company. The Company believes that

the risk of significant loss from the guarantees of these lease obligations is remote.

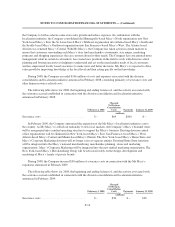

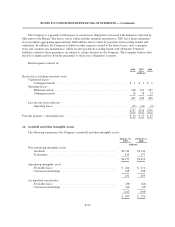

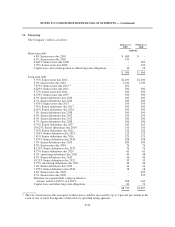

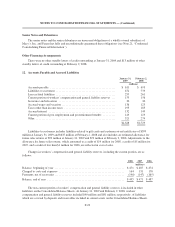

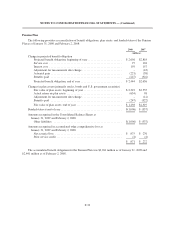

Rental expense consists of:

2008 2007 2006

(millions)

Real estate (excluding executory costs)

Capitalized leases –

Contingent rentals ..................................................$1$1$1

Operating leases –

Minimum rentals ................................................... 230 221 221

Contingent rentals .................................................. 16 18 23

247 240 245

Less income from subleases –

Operating leases ................................................... (15) (14) (9)

$232 $226 $236

Personal property – Operating leases ........................................... $ 19 $ 15 $ 15

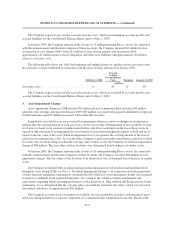

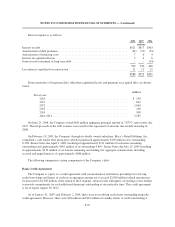

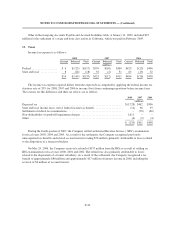

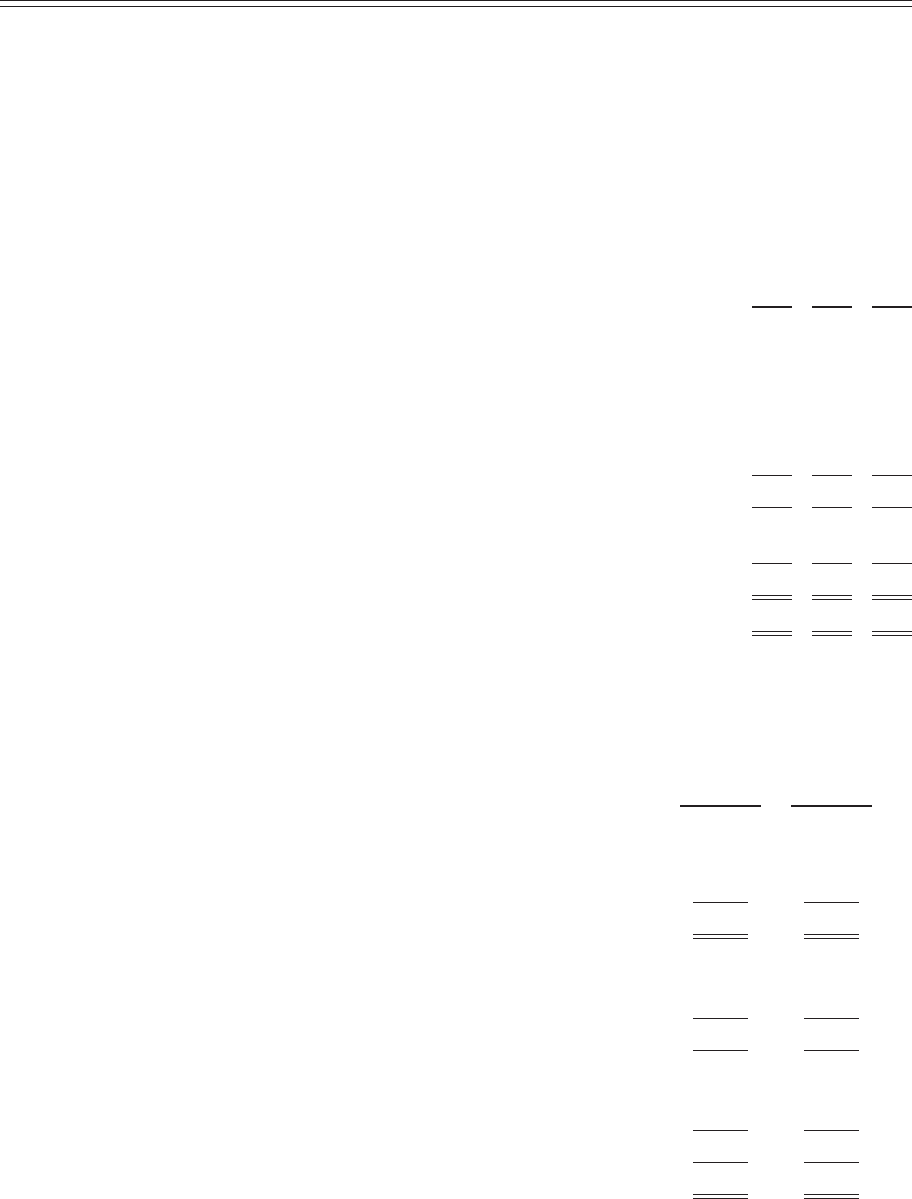

10. Goodwill and Other Intangible Assets

The following summarizes the Company’s goodwill and other intangible assets:

January 31,

2009

February 2,

2008

(millions)

Non-amortizing intangible assets

Goodwill ................................................. $3,743 $9,133

Tradenames ............................................... 414 477

$4,157 $9,610

Amortizing intangible assets

Favorable leases ........................................... $ 264 $ 271

Customer relationships ...................................... 188 188

452 459

Accumulated amortization

Favorable leases ........................................... (83) (60)

Customer relationships ...................................... (64) (45)

(147) (105)

$ 305 $ 354

F-24