Macy's 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

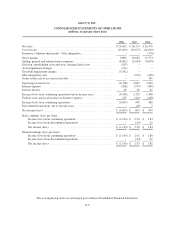

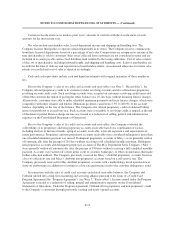

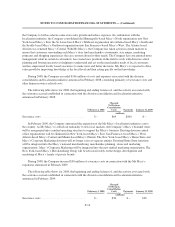

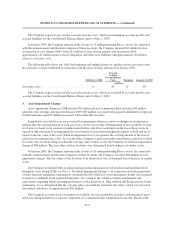

MACY’S, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(millions)

2008 2007 2006

Cash flows from continuing operating activities:

Net income (loss) ..................................................................... $(4,803) $ 893 $ 995

Adjustments to reconcile net income (loss) to net cash provided by continuing operating activities:

(Income) loss from discontinued operations ............................................. – 16 (7)

Gains on the sale of accounts receivable ............................................... – – (191)

Stock-based compensation expense ................................................... 43 60 91

Division consolidation costs and store closing related costs ................................ 187 – –

Asset impairment charges ........................................................... 211 – –

Goodwill impairment charges ........................................................ 5,382 – –

May integration costs .............................................................. – 219 628

Depreciation and amortization ....................................................... 1,278 1,304 1,265

Amortization of financing costs and premium on acquired debt ............................. (27) (31) (49)

Gain on early debt extinguishment .................................................... – – (54)

Changes in assets and liabilities:

Proceeds from sale of proprietary accounts receivable ................................. – – 1,860

Decrease in receivables ......................................................... 12 28 207

(Increase) decrease in merchandise inventories ...................................... 291 256 (51)

(Increase) decrease in supplies and prepaid expenses ................................. (7) 33 (41)

Decrease in other assets not separately identified ..................................... 1 3 25

Decrease in merchandise accounts payable ......................................... (90) (132) (462)

Decrease in accounts payable and accrued liabilities not separately identified .............. (227) (396) (410)

Increase (decrease) in current income taxes ......................................... (146) 14 (139)

Decrease in deferred income taxes ................................................ (291) (2) (18)

Increase (decrease) in other liabilities not separately identified .......................... 65 (34) 43

Net cash provided by continuing operating activities .............................. 1,879 2,231 3,692

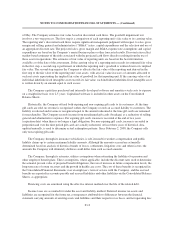

Cash flows from continuing investing activities:

Purchase of property and equipment ....................................................... (761) (994) (1,317)

Capitalized software ................................................................... (136) (111) (75)

Proceeds from hurricane insurance claims .................................................. 68 23 17

Disposition of property and equipment ..................................................... 38 227 679

Proceeds from the disposition of After Hours Formalwear ..................................... – 66 –

Proceeds from the disposition of Lord & Taylor ............................................. – – 1,047

Proceeds from the disposition of David’s Bridal and Priscilla of Boston ........................... – – 740

Repurchase of accounts receivable ........................................................ – – (1,141)

Proceeds from the sale of repurchased accounts receivable ..................................... – – 1,323

Net cash provided (used) by continuing investing activities ........................ (791) (789) 1,273

Cash flows from continuing financing activities:

Debt issued .......................................................................... 650 1,950 1,146

Financing costs ....................................................................... (18) (18) (10)

Debt repaid .......................................................................... (666) (649) (2,680)

Dividends paid ....................................................................... (221) (230) (274)

Decrease in outstanding checks .......................................................... (116) (57) (77)

Acquisition of treasury stock ............................................................ (1) (3,322) (2,500)

Issuance of common stock .............................................................. 7 257 382

Net cash used by continuing financing activities ................................. (365) (2,069) (4,013)

Net cash provided (used) by continuing operations ............................................... 723 (627) 952

Net cash provided by discontinued operating activities ............................................ – 7 54

Net cash used by discontinued investing activities ................................................ – (7) (97)

Net cash provided (used) by discontinued financing activities ....................................... – (1) 54

Net cash provided (used) by discontinued operations ............................................. – (1) 11

Net increase (decrease) in cash and cash equivalents .............................................. 723 (628) 963

Cash and cash equivalents beginning of period .................................................. 583 1,211 248

Cash and cash equivalents end of period ....................................................... $1,306 $ 583 $ 1,211

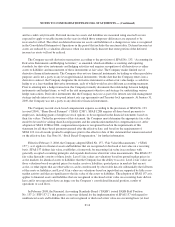

Supplemental cash flow information:

Interest paid .......................................................................... $ 642 $ 594 $ 600

Interest received ...................................................................... 26 38 59

Income taxes paid (net of refunds received) ................................................. 323 432 561

The accompanying notes are an integral part of these Consolidated Financial Statements.

F-8