Macy's 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Senior Notes and Debentures

The senior notes and the senior debentures are unsecured obligations of a wholly-owned subsidiary of

Macy’s, Inc. and Parent has fully and unconditionally guaranteed these obligations (see Note 21, “Condensed

Consolidating Financial Information”).

Other Financing Arrangements

There were no other standby letters of credit outstanding at January 31, 2009 and $13 million of other

standby letters of credit outstanding at February 2, 2008.

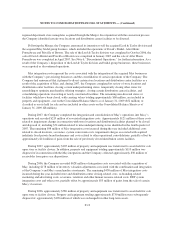

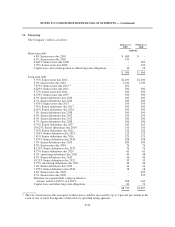

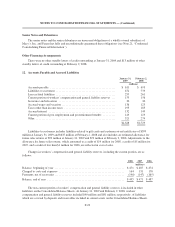

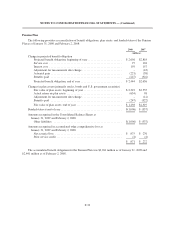

12. Accounts Payable and Accrued Liabilities

January 31,

2009

February 2,

2008

(millions)

Accounts payable .............................................. $ 611 $ 693

Liabilities to customers .......................................... 672 733

Lease related liabilities .......................................... 255 261

Current portion of workers’ compensation and general liability reserves . . . 153 156

Severance and relocation ........................................ 30 30

Accrued wages and vacation ...................................... 136 125

Taxes other than income taxes .................................... 195 185

Accrued interest ............................................... 132 149

Current portion of post employment and postretirement benefits ......... 123 123

Other ........................................................ 321 274

$2,628 $2,729

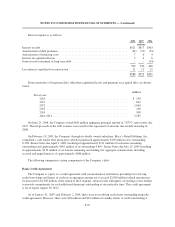

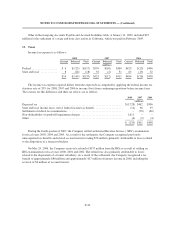

Liabilities to customers includes liabilities related to gift cards and customer award certificates of $599

million at January 31, 2009 and $635 million at February 2, 2008 and also includes an estimated allowance for

future sales returns of $59 million at January 31, 2009 and $73 million at February 2, 2008. Adjustments to the

allowance for future sales returns, which amounted to a credit of $14 million for 2008, a credit of $5 million for

2007, and a credit of less than $1 million for 2006, are reflected in cost of sales.

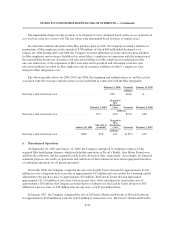

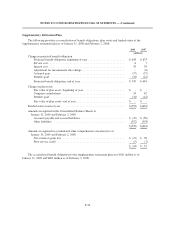

Changes in workers’ compensation and general liability reserves, including the current portion, are as

follows:

2008 2007 2006

(millions)

Balance, beginning of year ................................................. $471 $487 $474

Charged to costs and expenses .............................................. 164 131 178

Payments, net of recoveries ................................................. (140) (147) (165)

Balance, end of year ...................................................... $495 $471 $487

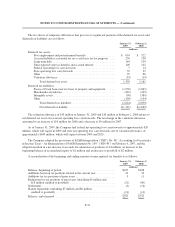

The non-current portion of workers’ compensation and general liability reserves is included in other

liabilities on the Consolidated Balance Sheets. At January 31, 2009 and February 2, 2008, workers’

compensation and general liability reserves included $90 million and $81 million, respectively, of liabilities

which are covered by deposits and receivables included in current assets on the Consolidated Balance Sheets.

F-29