Macy's 2008 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2008 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

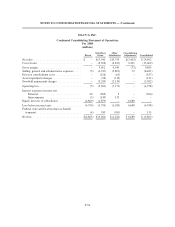

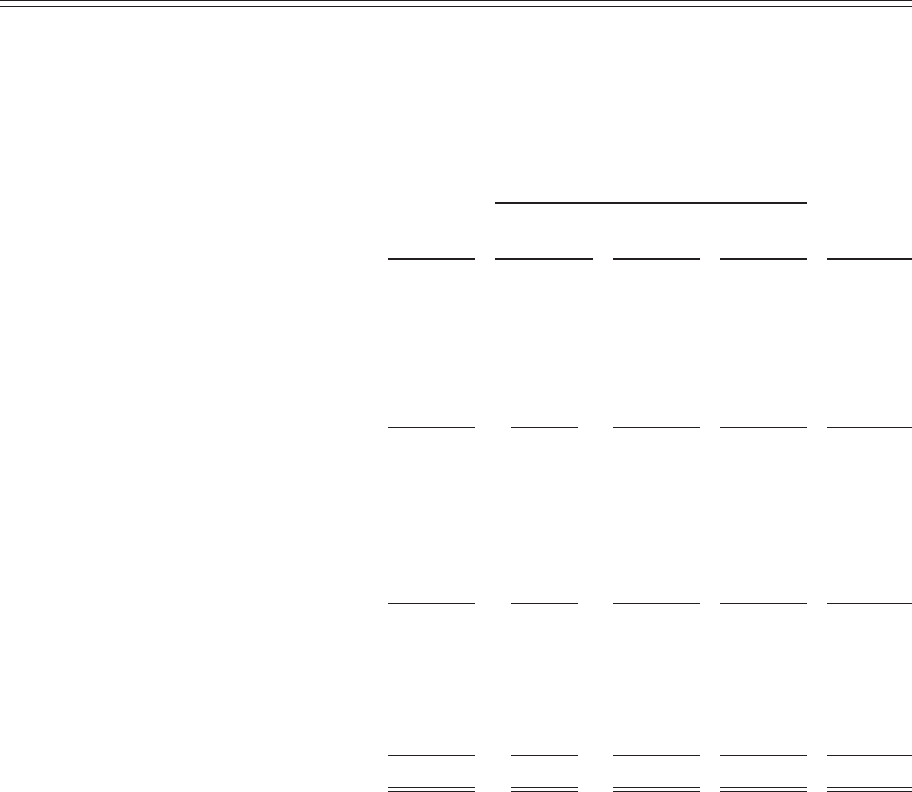

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

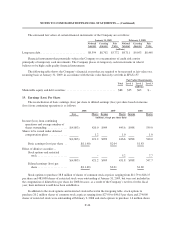

compensation plans. Under the deferred compensation plans, shares are maintained in a trust to cover the number

estimated to be needed for distribution on account of stock credits currently outstanding.

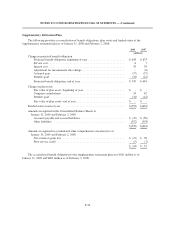

Changes in the Company’s Common Stock issued and outstanding, including shares held by the Company’s

treasury, are as follows:

Common

Stock

Issued

Treasury Stock

Common

Stock

Outstanding

Deferred

Compensation

Plans Other Total

(thousands)

Balance at January 28, 2006 .............. 598,408.8 (1,211.5) (50,411.0) (51,622.5) 546,786.3

Stock issued under stock plans ............ 5,629.7 (72.8) 6,988.8 6,916.0 12,545.7

Stock repurchases:

Repurchase program ................ (62,447.6) (62,447.6) (62,447.6)

Other ............................ (5.1) (5.1) (5.1)

Deferred compensation plan distributions . . . 45.3 45.3 45.3

Balance at February 3, 2007 .............. 604,038.5 (1,239.0) (105,874.9) (107,113.9) 496,924.6

Stock issued under stock plans ............ (81.3) 8,092.2 8,010.9 8,010.9

Stock repurchases:

Repurchase program ................ (85,219.5) (85,219.5) (85,219.5)

Other ............................ (73.2) (73.2) (73.2)

Deferred compensation plan distributions . . . 102.2 102.2 102.2

Retirement of common stock ............. (109,000.0) 109,000.0 109,000.0 –

Balance at February 2, 2008 .............. 495,038.5 (1,218.1) (74,075.4) (75,293.5) 419,745.0

Stock issued under stock plans ............ (157.6) 464.1 306.5 306.5

Stock repurchases:

Repurchase program ................ – –

Other ............................ (25.7) (25.7) (25.7)

Deferred compensation plan distributions . . . 58.0 58.0 58.0

Balance at January 31, 2009 .............. 495,038.5 (1,317.7) (73,637.0) (74,954.7) 420,083.8

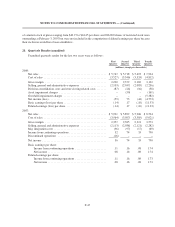

18. Financial Instruments and Concentrations of Credit Risk

The following methods and assumptions were used to estimate the fair value of each class of financial

instruments for which it is practicable to estimate that value:

Cash and cash equivalents and short-term investments

The carrying amount approximates fair value because of the short maturity of these instruments.

Long-term debt

The fair values of the Company’s long-term debt, excluding capitalized leases, are estimated based on the

quoted market prices for publicly traded debt or by using discounted cash flow analysis, based on the Company’s

current incremental borrowing rates for similar types of borrowing arrangements.

F-45