Macy's 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

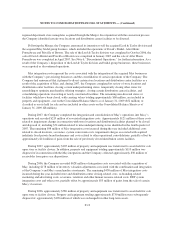

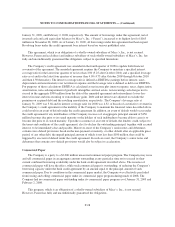

regional department store nameplates acquired through the Merger. In conjunction with the conversion process,

the Company identified certain store locations and distribution center facilities to be divested.

Following the Merger, the Company announced its intention to sell the acquired Lord & Taylor division and

the acquired May bridal group business, which included the operations of David’s Bridal, After Hours

Formalwear and Priscilla of Boston. The sale of the Lord & Taylor division was completed in October 2006, the

sale of David’s Bridal and Priscilla of Boston was completed in January 2007 and the sale of After Hours

Formalwear was completed in April 2007. See Note 6, “Discontinued Operations,” for further information. As a

result of the Company’s disposition of the Lord & Taylor division and bridal group businesses, these businesses

were reported as discontinued operations.

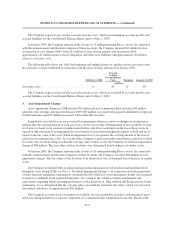

May integration costs represent the costs associated with the integration of the acquired May businesses

with the Company’s pre-existing businesses and the consolidation of certain operations of the Company. The

Company had announced that it planned to divest certain store locations and distribution center facilities as a

result of the acquisition of May, and, during 2007, the Company completed its review of store locations and

distribution center facilities, closing certain underperforming stores, temporarily closing other stores for

remodeling to optimize merchandise offering strategies, closing certain distribution center facilities, and

consolidating operations in existing or newly constructed facilities. The remaining non-divested stores or

facilities which have been closed, with carrying values totaling approximately $60 million, are included in

property and equipment – net on the Consolidated Balance Sheets as of January 31, 2009 ($52 million) or

classified as assets held for sale and are included in other assets on the Consolidated Balance Sheets as of

January 31, 2009 ($8 million).

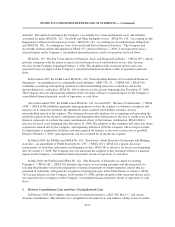

During 2007, the Company completed the integration and consolidation of May’s operations into Macy’s

operations and recorded $219 million of associated integration costs. Approximately $121 million of these costs

related to impairment charges in connection with store locations and distribution facilities planned to be closed

and disposed of, including $74 million related to nine underperforming stores identified in the fourth quarter of

2007. The remaining $98 million of May integration costs incurred during the year included additional costs

related to closed locations, severance, system conversion costs, impairment charges associated with acquired

indefinite lived private brand tradenames and costs related to other operational consolidations, partially offset by

approximately $41 million of gains from the sale of previously closed distribution center facilities.

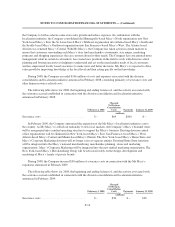

During 2007, approximately $105 million of property and equipment was transferred to assets held for sale

upon store or facility closure. In addition, property and equipment totaling approximately $110 million was

disposed of in connection with the May integration and the Company collected approximately $50 million of

receivables from prior year dispositions.

During 2006, the Company recorded $628 million of integration costs associated with the acquisition of

May, including $178 million of inventory valuation adjustments associated with the combination and integration

of the Company’s and May’s merchandise assortments. The remaining $450 million of May integration costs

incurred during the year included store and distribution center closing-related costs, re-branding-related

marketing and advertising costs, severance, retention and other human resource-related costs, EDP system

integration costs and other costs, partially offset by approximately $55 million of gains from the sale of certain

Macy’s locations.

During 2006, approximately $780 million of property and equipment was transferred to assets held for sale

upon store or facility closure. Property and equipment totaling approximately $730 million were subsequently

disposed of, approximately $190 million of which was exchanged for other long-term assets.

F-19