Macy's 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

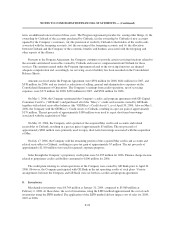

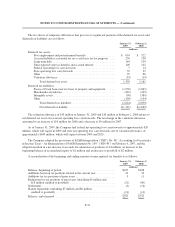

As of January 31, 2009 and February 2, 2008, the amount of unrecognized tax benefits, net of deferred tax

assets, that, if recognized would affect the effective income tax rate, was $160 million and $107 million,

respectively.

In conjunction with the adoption of FIN 48, the Company has classified unrecognized tax benefits not

expected to be settled within one year as other liabilities on the Consolidated Balance Sheets. At January 31,

2009, $215 million of unrecognized tax benefits is included in other liabilities and $22 million is included in

income taxes on the Consolidated Balance Sheets. At February 2, 2008, $229 million of unrecognized tax

benefits were included in other liabilities and $8 million were included in income taxes on the Consolidated

Balance Sheets.

Also in conjunction with the adoption of FIN 48 the Company has classified federal, state and local interest

and penalties not expected to be settled within one year as other liabilities on the Consolidated Balance Sheets

and adopted a policy of recognizing all interest and penalties related to unrecognized tax benefits in income tax

expense. In prior periods, such interest on federal tax issues was recognized as a component of interest income or

expense while such interest on state and local tax issues was already recognized as a component of income tax

expense. During 2008, 2007 and 2006, the Company recognized charges of $16 million, $3 million and $21

million, respectively, in income tax expense for federal, state and local interest and penalties.

The Company had approximately $79 million and $66 million accrued for the payment of federal, state and

local interest and penalties at January 31, 2009 and February 2, 2008, respectively. The accrued federal, state and

local interest and penalties primarily relates to state tax issues and the amount of penalties paid in prior periods,

and the amount of penalties accrued at January 31, 2009 and February 2, 2008 are insignificant. During 2008 and

2007, the accrual for federal, state and local interest and penalties was reduced by $3 million and $7 million,

respectively, and was recognized as a reduction of goodwill. At January 31, 2009, approximately $65 million of

federal, state and local interest and penalties is included in other liabilities and $14 million is included in income

taxes on the Consolidated Balance Sheets.

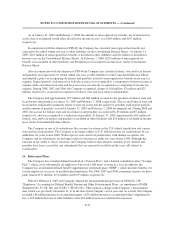

The Company or one of its subsidiaries files income tax returns in the U.S. federal jurisdiction and various

state and local jurisdictions. The Company is no longer subject to U.S. federal income tax examinations by tax

authorities for years before 2006. With respect to state and local jurisdictions, with limited exceptions, the

Company and its subsidiaries are no longer subject to income tax audits for years before 1998. Although the

outcome of tax audits is always uncertain, the Company believes that adequate amounts of tax, interest and

penalties have been accrued for any adjustments that are expected to result from the years still subject to

examination.

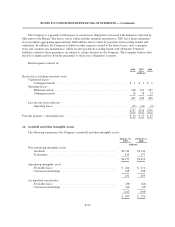

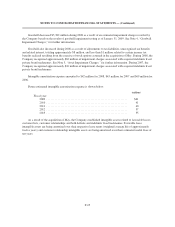

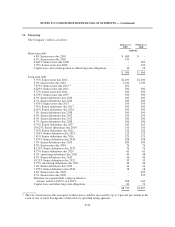

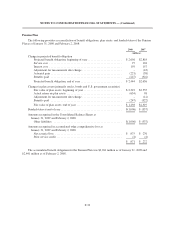

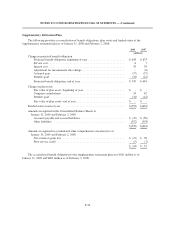

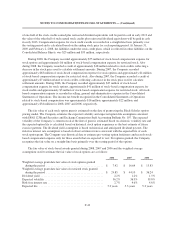

14. Retirement Plans

The Company has a funded defined benefit plan (“Pension Plan”) and a defined contribution plan (“Savings

Plan”), which cover substantially all employees who work 1,000 hours or more in a year. In addition, the

Company has an unfunded defined benefit supplementary retirement plan (“SERP”), which includes benefits, for

certain employees, in excess of qualified plan limitations. For 2008, 2007 and 2006, retirement expense for these

plans totaled $151 million, $170 million and $197 million, respectively.

Effective February 4, 2007, the Company adopted the measurement date provision of SFAS No. 158,

“Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans - an amendment of FASB

Statements No. 87, 88, 106, and 132(R)” (“SFAS 158”). This required a change in the Company’s measurement

date, which was previously December 31, to be the date of the Company’s fiscal year-end. As a result, the Company

recorded a $6 million decrease to accumulated equity, a $29 million decrease to accumulated other comprehensive

loss, a $37 million decrease to other liabilities and a $14 million increase to deferred income taxes.

F-32