Macy's 2008 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2008 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

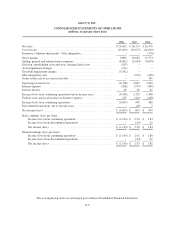

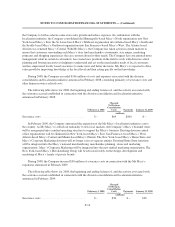

MACY’S, INC.

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(millions)

Common

Stock

Additional

Paid-In

Capital

Accumulated

Equity

Treasury

Stock

Accumulated

Other

Comprehensive

Income (Loss)

Total

Shareholders’

Equity

Balance at January 28, 2006 ......................... $6 $9,238 $ 5,654 $(1,091) $(288) $13,519

Net income ...................................... 995 995

Minimum pension liability adjustment, net of income tax

effect of $151 million ............................ 244 244

Unrealized gain on marketable securities, net of income tax

effect of $23 million ............................. 36 36

Total comprehensive income ........................ 1,275

Adjustment to initially apply SFAS No. 158, net of income

tax effect of $115 million ......................... (174) (174)

Common stock dividends ($.5075 per share) ............ (274) (274)

Stock repurchases ................................. (2,500) (2,500)

Stock-based compensation expense ................... 50 50

Stock issued under stock plans ....................... 158 159 317

Deferred compensation plan distributions .............. 1 1

Income tax benefit related to stock plan activity ......... 40 40

Balance at February 3, 2007, as previously reported ...... 6 9,486 6,375 (3,431) (182) 12,254

Cumulative effect of adopting new accounting

pronouncements ................................ – – (6) – 29 23

Balance at February 3, 2007, as revised ................ 6 9,486 6,369 (3,431) (153) 12,277

Net income ...................................... 893 893

Actuarial loss on post employment and postretirement

benefit plans, net of income tax effect of $4 million .... (6) (6)

Unrealized loss on marketable securities, net of income tax

effect of $22 million ............................. (35) (35)

Reclassifications to net income:

Net actuarial loss on post employment and

postretirement benefit plans, net of income tax

effect of $9 million .......................... 14 14

Prior service credit on post employment and

postretirement benefit plans, net of income tax

effect of $1 million .......................... (2) (2)

Total comprehensive income ........................ 864

Common stock dividends ($.5175 per share) ............ (230) (230)

Stock repurchases ................................. (3,322) (3,322)

Stock-based compensation expense ................... 67 67

Stock issued under stock plans ....................... (73) 278 205

Retirement of common stock ........................ (1) (3,915) 3,916 –

Deferred compensation plan distributions .............. 2 2

Income tax benefit related to stock plan activity ......... 44 44

Balance at February 2, 2008 ......................... 5 5,609 7,032 (2,557) (182) 9,907

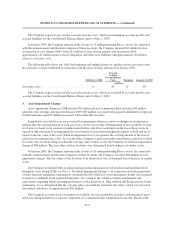

Net loss ......................................... (4,803) (4,803)

Actuarial loss on post employment and postretirement

benefit plans, net of income tax effect of $183 million . . (294) (294)

Unrealized loss on marketable securities, net of income tax

effect of $11 million ............................. (17) (17)

Reclassifications to net loss:

Realized loss on marketable securities, net of income

tax effect of $5 million ....................... 7 7

Net actuarial loss on post employment and

postretirement benefit plans, net of income tax

effect of $1 million .......................... 1 1

Prior service credit on post employment and

postretirement benefit plans, net of income tax

effect of $1 million .......................... (1) (1)

Total comprehensive loss ........................... (5,107)

Common stock dividends ($.5275 per share) ............ (221) (221)

Stock repurchases ................................. (1) (1)

Stock-based compensation expense ................... 61 61

Stock issued under stock plans ....................... (7) 13 6

Deferred compensation plan distributions .............. 1 1

Balance at January 31, 2009 ......................... $5 $5,663 $ 2,008 $(2,544) $(486) $ 4,646

The accompanying notes are an integral part of these Consolidated Financial Statements.

F-7