Macy's 2008 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2008 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

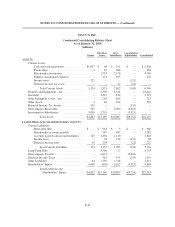

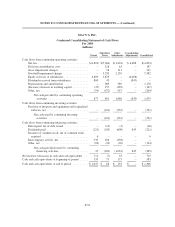

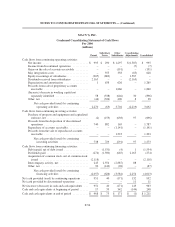

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

MACY’S, INC.

Condensed Consolidating Statement of Cash Flows

For 2006

(millions)

Parent

Subsidiary

Issuer

Other

Subsidiaries

Consolidating

Adjustments Consolidated

Cash flows from continuing operating activities:

Net income ................................ $ 995 $ 290 $1,297 $(1,587) $ 995

Income from discontinued operations ........... – – – (7) (7)

Gains on the sale of accounts receivable ......... – – (191) – (191)

May integrations costs ....................... – 355 358 (85) 628

Equity in earnings of subsidiaries ............... (905) (682) – 1,587 –

Dividends received from subsidiaries ........... 2,165 – – (2,165) –

Depreciation and amortization ................. 1 638 626 – 1,265

Proceeds from sale of proprietary accounts

receivable ............................... – – 1,860 – 1,860

(Increase) decrease in working capital not

separately identified ....................... 58 (338) (646) 30 (896)

Other, net ................................. (44) (326) 400 8 38

Net cash provided (used) by continuing

operating activities .................... 2,270 (63) 3,704 (2,219) 3,692

Cash flows from continuing investing activities:

Purchase of property and equipment and capitalized

software, net ............................. (2) (153) (638) 97 (696)

Proceeds from the disposition of discontinued

operations ............................... 740 882 165 – 1,787

Repurchase of accounts receivable .............. – – (1,141) – (1,141)

Proceeds from the sale of repurchased accounts

receivable ............................... – – 1,323 – 1,323

Net cash provided (used) by continuing

investing activities .................... 738 729 (291) 97 1,273

Cash flows from continuing financing activities:

Debt repaid, net of debt issued ................. – (1,531) (4) 1 (1,534)

Dividends paid ............................. (274) (1,500) (665) 2,165 (274)

Acquisition of common stock, net of common stock

issued .................................. (2,118) – – – (2,118)

Intercompany activity, net .................... 245 2,554 (2,887) 88 –

Other, net ................................. 90 (149) (28) – (87)

Net cash provided (used) by continuing

financing activities .................... (2,057) (626) (3,584) 2,254 (4,013)

Net cash provided (used) by continuing operations ..... 951 40 (171) 132 952

Net cash provided by discontinued operations ......... – – – 11 11

Net increase (decrease) in cash and cash equivalents . . . 951 40 (171) 143 963

Cash and cash equivalents at beginning of period ...... 17 33 342 (144) 248

Cash and cash equivalents at end of period ........... $ 968 $ 73 $ 171 $ (1) $1,211

F-56