Macy's 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

return assumption by evaluating input from several professional advisors taking into account the asset allocation

of the portfolio and long-term asset class return expectations, as well as long-term inflation assumptions.

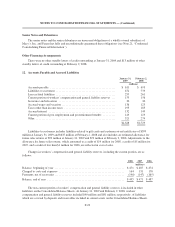

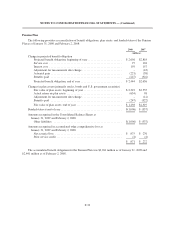

The following provides the weighted average asset allocations, by asset category, of the assets of the

Company’s Pension Plan as of January 31, 2009 and February 2, 2008 and the policy targets:

Targets 2008 2007

Equity securities ........................................................... 60% 49% 58%

Debt securities ............................................................ 25 27 26

Real estate ............................................................... 10 15 11

Other .................................................................... 5 9 5

100% 100% 100%

The assets of the Pension Plan are managed by investment specialists with the primary objectives of

payment of benefit obligations to the Plan participants and an ultimate realization of investment returns over

longer periods in excess of inflation. The Company employs a total return investment approach whereby a mix of

domestic and foreign equity securities, fixed income securities and other investments is used to maximize the

long-term return of the assets of the Pension Plan for a prudent level of risk. Risks are mitigated through the asset

diversification and the use of multiple investment managers.

No funding contributions were required, and the Company made no funding contributions to the Pension

Plan in 2008 or 2007. As of the date of this report, the Company is anticipating making required funding

contributions to the Pension Plan totaling approximately $295 million to $370 million prior to January 30, 2010.

This includes the initiation of quarterly contributions of approximately $30 million and a 2008 Plan year

contribution in September 2009 of approximately $175 million to $250 million.

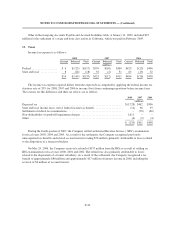

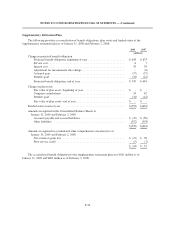

The following benefit payments are estimated to be paid from the Pension Plan:

(millions)

Fiscal year:

2009 ......................................................... $ 254

2010 ......................................................... 241

2011 ......................................................... 236

2012 ......................................................... 238

2013 ......................................................... 241

2014-2018 ..................................................... 1,118

F-35