Macy's 2008 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2008 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

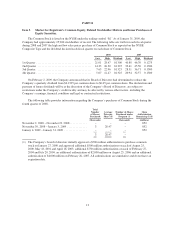

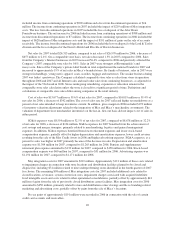

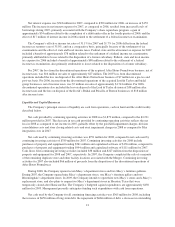

Item 6. Selected Financial Data.

The selected financial data set forth below should be read in conjunction with the Consolidated Financial

Statements and the notes thereto and the other information contained elsewhere in this report.

2008 2007 2006* 2005** 2004

(millions, except per share data)

Consolidated Statement of Operations Data:

Net sales ............................................. $24,892 $ 26,313 $ 26,970 $ 22,390 $15,776

Cost of sales .......................................... (15,009) (15,677) (16,019) (13,272) (9,382)

Inventory valuation adjustments – May integration ............ – – (178) (25) –

Gross margin .......................................... 9,883 10,636 10,773 9,093 6,394

Selling, general and administrative expenses ................. (8,481) (8,554) (8,678) (6,980) (4,994)

Division consolidation costs and store closing related costs ..... (187) – – – –

Asset impairment charges ................................ (211) – – – –

Goodwill impairment charges ............................ (5,382) – – – –

May integration costs ................................... – (219) (450) (169) –

Gains on sale of accounts receivable ....................... – – 191 480 –

Operating income (loss) ................................. (4,378) 1,863 1,836 2,424 1,400

Interest expense (a) ..................................... (588) (579) (451) (422) (299)

Interest income ........................................ 28 36 61 42 15

Income (loss) from continuing operations before income taxes . . . (4,938) 1,320 1,446 2,044 1,116

Federal, state and local income tax benefit (expense) .......... 135 (411) (458) (671) (427)

Income (loss) from continuing operations ................... (4,803) 909 988 1,373 689

Discontinued operations, net of income taxes (b) ............. – (16) 7 33 –

Net income (loss) ...................................... $ (4,803) $ 893 $ 995 $ 1,406 $ 689

Basic earnings (loss) per share: (c)

Income (loss) from continuing operations ................... $ (11.40) $ 2.04 $ 1.83 $ 3.22 $ 1.97

Net income (loss) ...................................... (11.40) 2.00 1.84 3.30 1.97

Diluted earnings (loss) per share: (c)

Income (loss) from continuing operations ................... $ (11.40) $ 2.01 $ 1.80 $ 3.16 $ 1.93

Net income (loss) ...................................... (11.40) 1.97 1.81 3.24 1.93

Average number of shares outstanding (c) ....................... 420.0 445.6 539.0 425.2 349.0

Cash dividends paid per share (c) .............................. $ .5275 $ .5175 $ .5075 $ .385 $ .265

Depreciation and amortization ................................ $ 1,278 $ 1,304 $ 1,265 $ 976 $ 737

Capital expenditures ........................................ $ 897 $ 1,105 $ 1,392 $ 656 $ 548

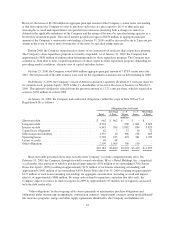

Balance Sheet Data (at year end):

Cash and cash equivalents ............................... $ 1,306 $ 583 $ 1,211 $ 248 $ 868

Total assets ........................................... 22,145 27,789 29,550 33,168 14,885

Short-term debt ........................................ 966 666 650 1,323 1,242

Long-term debt ........................................ 8,733 9,087 7,847 8,860 2,637

Shareholders’ equity .................................... 4,646 9,907 12,254 13,519 6,167

* 53 weeks

** The May Department Stores Company was acquired August 30, 2005 and the results of the acquired operations have

been included in the Company’s results of operations from the date of the acquisition.

(a) Interest expense includes a gain of approximately $54 million in 2006 related to the completion of a debt tender offer and

a cost of approximately $59 million in 2004 associated with repurchases of the Company’s long-term debt.

(b) Discontinued operations include (1) for 2007, the after-tax results of the After Hours Formalwear business, including an

after-tax loss of $7 million on the disposal of After Hours Formalwear, (2) for 2006, the after-tax results of operations of

the Lord & Taylor division and the Bridal Group division (including David’s Bridal, After Hours Formalwear, and

Priscilla of Boston), including after-tax losses of $38 million and $18 million on the disposals of the Lord & Taylor

division and the David’s Bridal and Priscilla of Boston businesses, respectively, and (3) for 2005, the after-tax results of

operations of the Lord & Taylor division and the Bridal Group division.

(c) Share and per share amounts have been adjusted as appropriate to reflect the two-for-one stock-split effected in the form

of a stock dividend distributed on June 9, 2006.

15