Macy's 2008 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2008 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

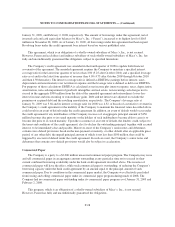

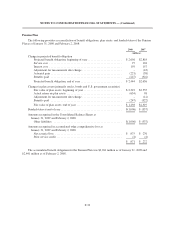

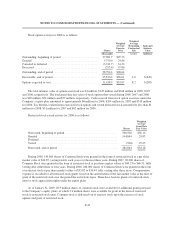

The following benefit payments are estimated to be funded by the Company and paid from the

supplementary retirement plan:

(millions)

Fiscal year:

2009 ......................................................... $ 47

2010 ......................................................... 49

2011 ......................................................... 50

2012 ......................................................... 51

2013 ......................................................... 53

2014-2018 ..................................................... 262

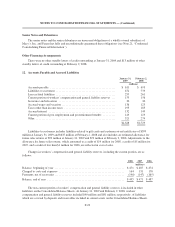

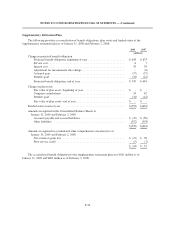

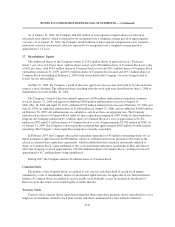

Savings Plan

The Savings Plan includes a voluntary savings feature for eligible employees. The Company’s contribution

is based on the Company’s annual earnings and prior to January 1, 2009, the minimum contribution was 33

1

⁄

3

%

of an employee’s eligible savings. Expense for the Savings Plan amounted to $37 million for 2008, $38 million

for 2007 and $39 million for 2006.

Deferred Compensation Plan

The Company has a deferred compensation plan wherein eligible executives may elect to defer a portion of

their compensation each year as either stock credits or cash credits. The Company transfers shares to a trust to

cover the number management estimates will be needed for distribution on account of stock credits currently

outstanding. At January 31, 2009 and February 2, 2008, the liability under the plan, which is reflected in other

liabilities on the Consolidated Balance Sheets, was $52 million and $51 million, respectively. Expense for 2008,

2007 and 2006 was immaterial.

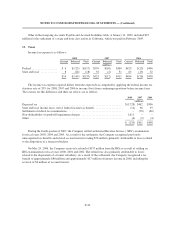

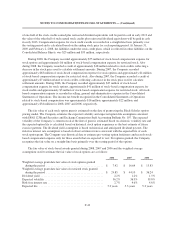

15. Postretirement Health Care and Life Insurance Benefits

In addition to pension and other supplemental benefits, certain retired employees currently are provided

with specified health care and life insurance benefits. Eligibility requirements for such benefits vary by division

and subsidiary, but generally state that benefits are available to eligible employees who were hired prior to a

certain date and retire after a certain age with specified years of service. Certain employees are subject to having

such benefits modified or terminated.

Effective February 4, 2007, the Company adopted the measurement date provision of SFAS 158. This

required a change in the Company’s measurement date, which was previously December 31, to be the date of the

Company’s fiscal year-end. As a result, the Company recorded a $1 million decrease to accumulated equity and a

$1 million increase to other liabilities.

F-38