Lumber Liquidators 2008 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2008 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

The information required by this Item is incorporated by reference from the definitive proxy statement for

our 2009 annual meeting of shareholders, which will be filed no later than 120 days after December 31, 2008.

Code of Ethics

We have a Code of Conduct, which applies to all employees, officers and directors of Lumber Liquidators,

Inc. Our Code of Conduct meets the requirements of a “code of ethics” as defined by Item 406 of Regulation

S-K, and applies to our Chief Executive Officer, Chief Financial Officer (who is both our principal financial and

principal accounting officer), as well as all other employees. Our Code of Conduct also meets the requirements

of a code of conduct under Marketplace Rule 4350(n) of the National Association of Securities Dealers, Inc. Our

Code of Conduct is posted on our website at http://www.lumberliquidators.com in the “Corporate Governance”

section of our Investor Relations home page.

Item 11. Executive Compensation.

The information required by this Item is incorporated by reference from the definitive proxy statement for

our 2009 annual meeting of shareholders, which will be filed no later than 120 days after December 31, 2008.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder

Matters.

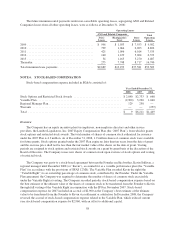

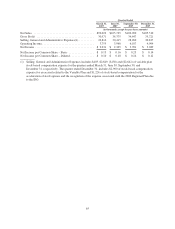

The following table summarizes information about our equity compensation plans as of December 31, 2008.

Shares issued under all of the following plans may be from treasury, newly issued or both.

(a)

Number of

Securities to be

Issued Upon

Exercise of

Outstanding

Options, Warrants

and Rights(1)

(b)

Weighted-average

Exercise Price of

Outstanding Options,

Warrants and

Rights(1)

(c)

Number of Securities

Remaining Available for

Future Issuance Under

Equity Compensation

Plans (excluding

securities included in

column (a))

Equity Compensation Plans Approved by Security

Holders ................................ 2,358,880 $8.27 1,885,940

Equity Compensation Plans Not Approved by

Security Holders ......................... —— —

Total .................................... 2,358,880 $8.27 1,885,940

(1) Includes shares issuable in connection with non-employee director restricted stock units. The weighted-

average exercise price in column (b) includes the weighted-average exercise price of stock options.

The additional information required by this Item is incorporated by reference from the definitive proxy

statement for our 2009 annual meeting of shareholders, which will be filed no later than 120 days after

December 31, 2008.

67