Lumber Liquidators 2008 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2008 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

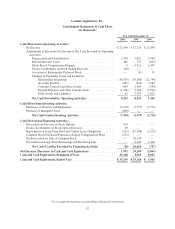

Cash and Cash Equivalents

In 2008, cash and cash equivalents increased $2.0 million to $35.1 million. The primary contributor to the

increase in cash and cash equivalents was $9.4 million of cash provided by operating activities, partially offset by

the use of $6.6 million to purchase property and equipment and $0.8 million to purchase the phone number

1-800-HARDWOOD and related internet domain names. During 2007, cash and cash equivalents increased $29.2

million to $33.2 million. We received $36.2 million from our IPO in November 2007 and operating activities

provided $8.5 million. These increases of cash and cash equivalents were partially offset by the use of $6.0

million to purchase property and equipment and $9.5 million of net repayments of long-term debt and capital

leases. The primary contributors to the $2.1 million decrease in cash and cash equivalents during 2006 were the

use of $2.7 million of cash for purchases of property and equipment and $2.2 million of cash to repay scheduled

long-term debt and capital lease payments, partially offset by $1.4 million of cash provided by operating

activities and borrowings of $1.5 million under our revolving loan agreement.

Cash Flows

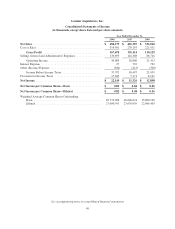

Operating Activities. Net cash provided by operating activities was $9.4 million for 2008, and $8.5 million

for 2007 compared to $1.4 million for 2006. The $0.8 million increase from 2007 to 2008 reflects more

profitable operations and a lesser build in inventory net of accounts payable, partially offset by the timing of

changes in certain other assets and liabilities. The $7.1 million increase in comparing 2007 to 2006 was primarily

attributable to more profitable operations, exclusive of the $4.8 million increase in non-cash stock-based

compensation expense, a greater build in inventory net of accounts payable and the timing of the changes in

certain other assets and liabilities.

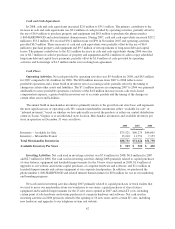

The annual build in merchandise inventories primarily relates to the growth in our store base, and represents

the most significant use of operating cash. We consider merchandise inventories either “available for sale” or

“inbound in-transit,” based on whether we have physically received the products at either our central distribution

center in Toano, Virginia or at an individual store location. Merchandise inventories and available inventory per

store in operation on December 31 were as follows:

2008 2007 2006

(in thousands)

Inventory – Available for Sale ......................................... $75,521 $60,273 $44,605

Inventory – Inbound In-Transit ........................................ 13,210 11,751 7,153

Total Merchandise Inventories ....................................... $88,731 $72,024 $51,758

Available Inventory Per Store ........................................ $ 503 $ 520 $ 490

Investing Activities. Net cash used in investing activities was $7.4 million for 2008, $6.0 million for 2007

and $2.7 million for 2006. Net cash used in investing activities during 2008 primarily related to capital purchases

of store fixtures, equipment and leasehold improvements for the 34 new stores opened in 2008, $1.4 million of

upgrades to our website and routine capital purchases of computer hardware and software, and $1.1 million in

leasehold improvements and certain equipment at our corporate headquarters. In addition, we purchased the

phone number 1-800-HARDWOOD and related internet domain names for $0.8 million for use in our marketing

and branding programs.

Net cash used in investing activities during 2007 primarily related to capital purchases of truck trailers that

we used to move our merchandise from our warehouse to our stores, capital purchases of store fixtures,

equipment and leasehold improvements for the 25 new stores opened in 2007 and certain IT costs, including

certain point of sale hardware and routine purchases of computer hardware and software. Net cash used in

investing activities in 2006 primarily related to the opening of 16 new stores and to certain IT costs, including

new hardware and upgrades to our telephone system and website.

42