Lumber Liquidators 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

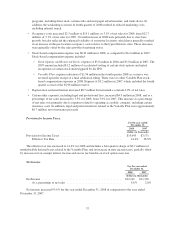

• Expenses related to domestic and international transportation generally increased in comparing 2008 to

2007. Rising fuel costs generally increased the average cost of an inbound international container and

the average per-mile ground charge. These fuel costs which had significantly risen in 2008, declined

sharply in the fourth quarter. As a component of the product unit cost, however, the gross margin

impact of a change in fuel costs tends to lag by 60 to 120 days. In addition, a number of logistics

initiatives have been implemented to reduce the miles driven by trucks supplying merchandise

inventories to our stores. These initiatives began in the third and fourth quarter of 2007 and continued

throughout 2008.

• Liquidation deals favorably impacted 2008 gross margin in three ways:

• In the second quarter of 2008, we strengthened our merchandising staff to enhance our focus on

the entire product cycle of liquidation deals, an important component of both our product

assortment and our promotional marketing campaigns.

• Certain special higher than average quality and unit count liquidation deals were available

throughout 2008, but particularly in the first and second quarters. We estimate that these special

buys, which are difficult to anticipate in future periods, benefited gross margin by approximately

10 to 15 basis points in comparing 2008 to the prior year.

• The promotional opportunities surrounding these special liquidation deals generated incremental

consumer traffic, a certain portion of which we believe converted to our proprietary products,

particularly our laminates, contributing up to approximately 7 to 8 basis points to the

improvement in our gross margin for the year.

• A tariff on certain bamboo products was reduced in the second quarter of 2008. The tariff was

originally implemented in the second quarter of 2007 and was rebated retroactively on an individual

entry basis. Gross margin for 2008 benefited from the retroactive rebate by approximately 20 basis

points. We completed the rebate process in the third quarter of 2008.

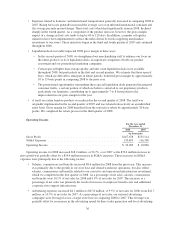

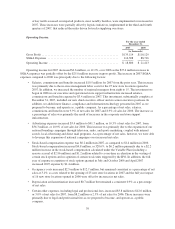

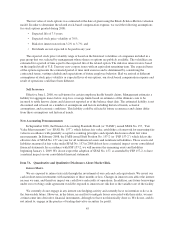

Operating Income.

For the year ended

December 31,

2008 2007

(in thousands)

Gross Profit .................................................... $167,678 $135,114

SG&A Expenses ................................................ 130,693 116,308

Operating Income ............................................... $ 36,985 $ 18,806

Operating income for 2008 increased $18.2 million, or 96.7%, over 2007 as the $32.6 million increase in

gross profit was partially offset by a $14.4 million increase in SG&A expenses. These increases in SG&A

expenses were principally due to the following factors:

• Salaries, commissions and benefits increased $8.6 million for 2008 from the prior year. This increase

was primarily due to the growth in our store base and related warehouse operations, but also reflect

salaries, commissions and benefits related to our executive and operational infrastructure investment,

which we completed in the first quarter of 2008. As a percentage of net sales, salaries, commissions

and benefits were 10.1% of net sales for 2008 and 9.9% of net sales for 2007. This increase as a

percentage of net sales was primarily the result of increases in employee benefit costs and additional

corporate store support infrastructure.

• Advertising expenses increased $4.1 million to $45.8 million, or 9.5% of net sales for 2008, from $41.7

million, or 10.3% of net sales for 2007. As a percentage of net sales, our national advertising

campaigns were leveraged across a larger store base in comparing 2008 to 2007. This leverage was

partially offset by an increase in the advertising spend for direct sales generation and local advertising

36