Lumber Liquidators 2008 Annual Report Download - page 61

Download and view the complete annual report

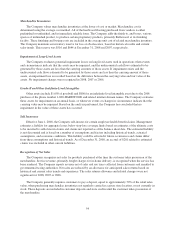

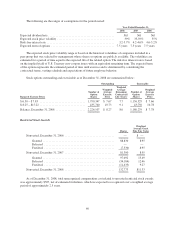

Please find page 61 of the 2008 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Cost of Sales

The cost of sales includes the actual cost of the merchandise sold, the transportation costs from vendor to

the Company’s distribution center or store location, any applicable finishing costs related to production of the

Company’s proprietary brand, the transportation costs from the distribution center to the store locations, and any

inventory adjustments, including shrinkage.

The Company includes transportation costs for the delivery of products directly from stores to customers in

cost of sales if delivered by third parties or in selling, general and administrative expenses (or “SG&A”) if

delivered by the Company’s delivery fleet. Costs related to the Company’s delivery fleet, which include delivery

salaries, maintenance and depreciation, totaled approximately $1,077 in 2008 and $1,600 in 2007 and 2006.

The Company offers a range of prefinished products with warranties on the durability of the finish ranging

from 10 to 50 years. Warranty reserves are based primarily on claims experience, sales history and other

considerations, and warranty costs are recorded in the cost of sales. Warranty costs and changes to the warranty

reserve were not significant for 2008, 2007 or 2006.

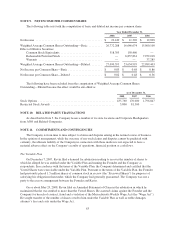

Advertising Costs

Advertising costs charged to SG&A were $45,762, $41,693 and $36,288 in 2008, 2007 and 2006,

respectively. The Company uses various types of media to brand its name and advertise its products. Media

production costs are generally expensed as incurred, except for direct mail, which is expensed when the finished

piece enters the postal system. Media placement costs are generally expensed in the month the advertising

occurs, except for contracted endorsements and sports agreements, which are generally expensed ratably over the

contract period. Amounts paid in advance are included in prepaid expenses and totaled $3,282 and $1,935 at

December 31, 2008 and 2007, respectively.

Store Opening Costs

Costs to open new store locations are charged to SG&A as incurred.

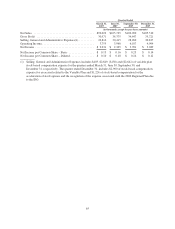

Depreciation and Amortization

Property and equipment is carried at cost and depreciated on the straight-line method over the estimated

useful lives of the related assets. Vehicles and office equipment are depreciated over useful lives which range

from three to seven years, and finishing equipment is depreciated over five years. The estimated useful lives for

leasehold improvements are the shorter of the estimated useful lives or the remainder of the lease terms. For

leases with optional renewal periods, the Company uses the original lease term, excluding optional renewal

periods to determine the appropriate estimated useful lives. Leasehold improvements are currently being

amortized over useful lives which range from one to fifteen years.

Operating Leases

The Company has operating leases for its stores, Corporate Headquarters and certain equipment. The lease

agreements for certain stores contain rent escalation clauses and rent holidays. For scheduled rent escalation

clauses during the lease terms or for rental payments commencing at a date other than the date of initial

occupancy, the Company records minimum rental expenses on a straight-line basis over the terms of the leases in

SG&A. The difference between the rental expense and rent paid is recorded as deferred rent in the consolidated

balance sheets.

55