Lumber Liquidators 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company maintains a stock unit plan for regional store management, the 2006 Stock Unit Plan for

Regional Managers (the “2006 Regional Plan”). In 2006, certain Regional Managers were granted a total of

85,000 stock units vesting over approximately a five year period with the Founder contributing the 85,000 shares

of common stock necessary to provide for the exercise of the stock units. No additional grants of stock units are

available under the 2006 Regional Plan. The stock units would have expired without value unless a trigger event,

as defined, occurred. The IPO was a trigger event, and the Company recorded $258 of stock-based compensation

expense in the fourth quarter of 2007. Through December 2008, 51,000 stock units had vested and the Founder

had transferred the corresponding shares of common stock. Pursuant to the provisions of the 2006 Regional Plan,

the Company purchased 10,406 shares of common stock from the Regional Managers at the fair market value on

the vest dates for a total of $103, to cover applicable federal and state withholding taxes. We expect the

remaining $258 of stock-based compensation expense to be recognized over the next 2 years.

In 2004, the Company established a stock warrant plan (the “Warrant Plan”) with a senior executive who

separated from the Company in May 2006. As a result of the separation during the second quarter of 2006, the

Company reversed the $259 of compensation expense that had been previously recognized.

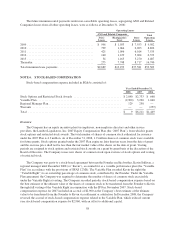

Stock Options

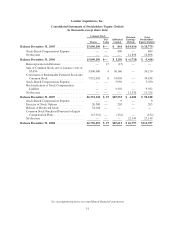

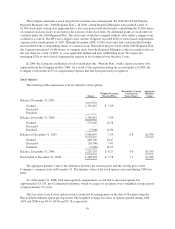

The following table summarizes activity related to stock options:

Shares

Weighted Average

Exercise Price

Remaining Average

Contractual

Term (Years)

Aggregate

Intrinsic

Value

Balance, December 31, 2005 .................. —

Granted ............................... 1,796,847 $ 7.69

Exercised .............................. —

Forfeited .............................. —

Balance, December 31, 2006 .................. 1,796,847 7.69

Granted ............................... 175,000 10.78

Exercised .............................. —

Forfeited .............................. (5,000) 11.00

Balance at December 31, 2007 ................. 1,966,847 7.95 8.8 $2,038

Granted ............................... 288,760 10.47

Exercised .............................. (26,500) 7.67

Forfeited .............................. (3,000) 16.55

Balance, December 31, 2008 .................. 2,226,107 $ 8.27 8.0 $5,199

Exercisable at December 31, 2008 .............. 1,180,279 $ 7.78 7.7 $3,296

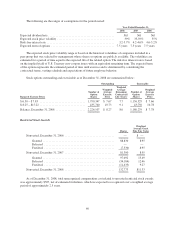

The aggregate intrinsic value is the difference between the exercise price and the closing price of the

Company’s common stock on December 31. The intrinsic value of the stock options exercised during 2008 was

$201.

As of December 31, 2008, total unrecognized compensation cost related to unvested options was

approximately $3,243, net of estimated forfeitures, which we expect to recognize over a weighted average period

of approximately 2.0 years.

The fair value of each stock option award is estimated by management on the date of the grant using the

Black-Scholes-Merton option pricing model. The weighted average fair value of options granted during 2008,

2007 and 2006 were $4.99, $4.08 and $3.74, respectively.

59