Lumber Liquidators 2008 Annual Report Download - page 51

Download and view the complete annual report

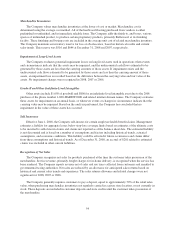

Please find page 51 of the 2008 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The fair value of stock options was estimated at the date of grant using the Black-Scholes-Merton valuation

model. In order to determine the related stock-based compensation expense, we used the following assumptions

for stock options granted during 2008:

• Expected life of 7.5 years;

• Expected stock price volatility of 39%;

• Risk-free interest rates from 3.2% to 3.7%; and

• Dividends are not expected to be paid in any year.

The expected stock price volatility range is based on the historical volatilities of companies included in a

peer group that was selected by management whose shares or options are publicly available. The volatilities are

estimated for a period of time equal to the expected life of the related option. The risk-free interest rate is based

on the implied yield of U.S. Treasury zero-coupon issues with an equivalent remaining term. The expected term

of the options represents the estimated period of time until exercise and is determined by considering the

contractual terms, vesting schedule and expectations of future employee behavior. Had we arrived at different

assumptions of stock price volatility or expected lives of our options, our stock-based compensation expense and

result of operations could have been different.

Self Insurance

Effective June 1, 2008, we self-insure for certain employee health benefit claims. Management estimates a

liability for aggregate losses below stop-loss coverage limits based on estimates of the ultimate costs to be

incurred to settle known claims and claims not reported as of the balance sheet date. The estimated liability is not

discounted and is based on a number of assumptions and factors including historical trends, actuarial

assumptions, and economic conditions. This liability could be affected if future occurrences and claims differ

from these assumptions and historical trends.

New Accounting Pronouncements

In September 2006, the Financial Accounting Standards Board (or “FASB”) issued SFAS No. 157, “Fair

Value Measurements” (or “SFAS No. 157”), which defines fair value, establishes a framework for measuring fair

value in accordance with generally accepted accounting principles and expands disclosures about fair value

measurements. In February 2008, the FASB issued Staff Position No. 157-2 (or “FSP 157-2”) which delays the

effective date of SFAS No. 157 one year for all nonfinancial assets and nonfinancial liabilities. Those assets and

liabilities measured at fair value under SFAS No. 157 in 2008 did not have a material impact on our consolidated

financial statements. In accordance with FSP 157-2, we will measure the remaining assets and liabilities

beginning January 1, 2009. We do not expect the adoption of SFAS No. 157, as amended by FSP 157-2, to have

a material impact on our consolidated financial statements.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

Interest Rates.

We are exposed to interest rate risk through the investment of our cash and cash equivalents. We invest our

cash in short-term investments with maturities of three months or less. Changes in interest rates affect the interest

income we earn, and therefore impact our cash flows and results of operations. In addition, any future borrowings

under our revolving credit agreement would be exposed to interest rate risk due to the variable rate of the facility.

We currently do not engage in any interest rate hedging activity and currently have no intention to do so in

the foreseeable future. However, in the future, in an effort to mitigate losses associated with these risks, we may

at times enter into derivative financial instruments, although we have not historically done so. We do not, and do

not intend to, engage in the practice of trading derivative securities for profit.

45