Lumber Liquidators 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

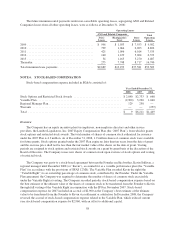

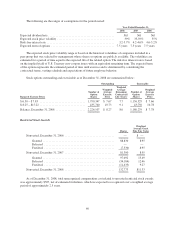

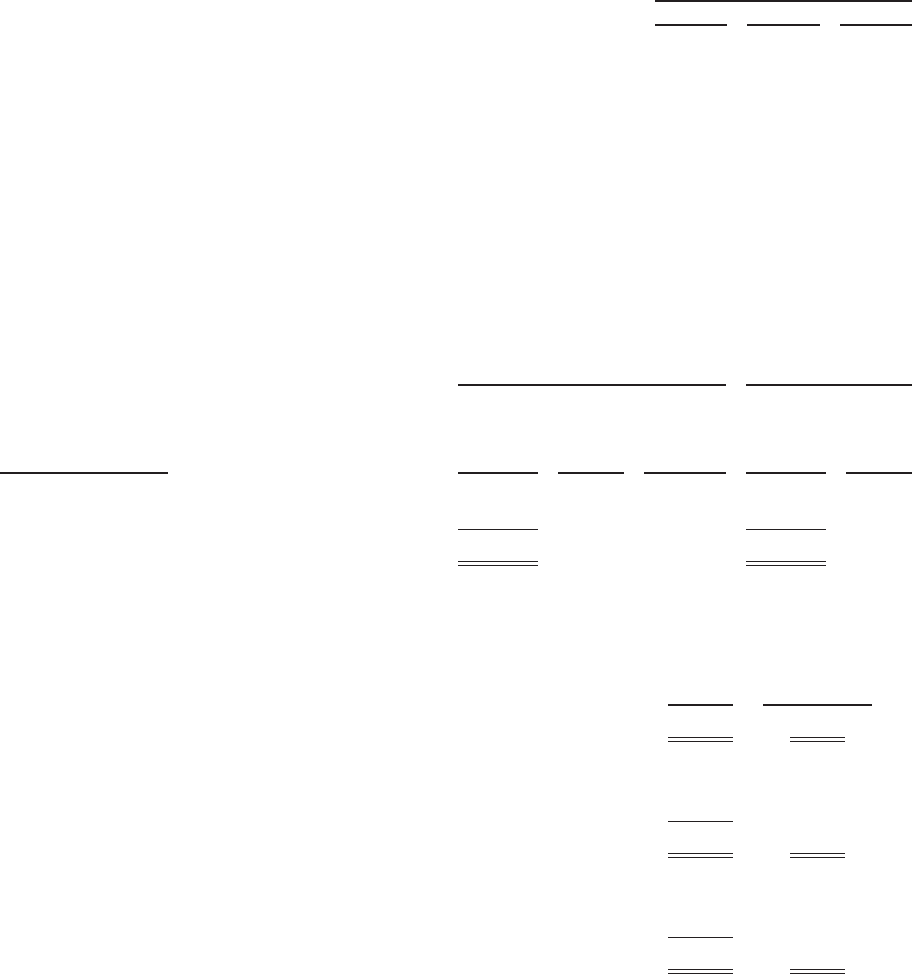

The following are the ranges of assumptions for the periods noted:

Year Ended December 31,

2008 2007 2006

Expected dividend rate ............................................. Nil Nil Nil

Expected stock price volatility ....................................... 39% 35-39% 35%

Risk-free interest rate .............................................. 3.2-3.7% 4.2-4.6% 4.6-5.2%

Expected term of options ........................................... 7.5years 7.5 years 7.5 years

The expected stock price volatility range is based on the historical volatilities of companies included in a

peer group that was selected by management whose shares or options are publicly available. The volatilities are

estimated for a period of time equal to the expected life of the related option. The risk-free interest rate is based

on the implied yield of U.S. Treasury zero-coupon issues with an equivalent remaining term. The expected term

of the options represents the estimated period of time until exercise and is determined by considering the

contractual terms, vesting schedule and expectations of future employee behavior.

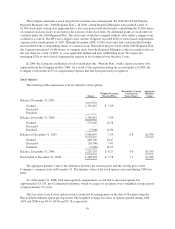

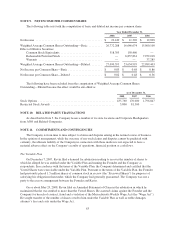

Stock options outstanding and exercisable as of December 31, 2008 are summarized below:

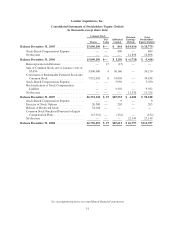

Outstanding Exercisable

Range of Exercise Prices

Number of

Option

Shares

Weighted

Average

Exercise

Price

Weighted

Average

Remaining

Contractual

Life (Years)

Number of

Option

Shares

Weighted

Average

Exercise

Price

$ 6.50 – $ 7.83 ............................... 1,790,347 $ 7.67 7.7 1,136,529 $ 7.66

$ 8.25 – $15.22 ............................... 435,760 10.73 9.1 43,750 10.78

Balance, December 31, 2008 .................... 2,226,107 $ 8.27 8.0 1,180,279 $ 7.78

Restricted Stock Awards

Shares

Weighted

Average Grant

Date Fair Value

Nonvested, December 31, 2006 .................................. — $ —

Granted ................................................. 88,830 8.95

Released ................................................ — —

Forfeited ................................................ (7,530) 8.95

Nonvested, December 31, 2007 .................................. 81,300 8.95

Granted ................................................. 97,092 13.49

Released ................................................ (34,184) 12.46

Forfeited ................................................ (11,435) 9.27

Nonvested, December 31, 2008 .................................. 132,773 $11.33

As of December 31, 2008, total unrecognized compensation cost related to unvested restricted stock awards

was approximately $507, net of estimated forfeitures, which we expected to recognized over a weighted average

period of approximately 2.5 years.

60