Lumber Liquidators 2008 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2008 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities.

Market Information

Our common stock trades on the New York Stock Exchange (or “NYSE”) under the trading symbol “LL.”

We are authorized to issue up to 35,000,000 shares of common stock, par value $0.001. Total shares of common

stock outstanding at March 3, 2009 were 26,791,891, and we had 19 stockholders of record.

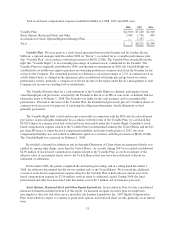

The following table shows the quarterly high and low closing sales prices as reported by the NYSE for each

quarter during the last two fiscal years that our common stock was publicly traded.

Price Range

High Low

2008:

Fourth Quarter .................................................. $11.96 $ 8.03

Third Quarter ................................................... 15.22 11.62

Second Quarter ................................................. 16.55 10.67

First Quarter ................................................... 11.03 6.07

2007:

Fourth Quarter(1) ............................................... 9.76 7.83

(1) Our common stock began trading on the NYSE on November 9, 2007; therefore the price range for the

fourth quarter of 2007 represents the high and low closing sales prices from November 9, 2007 through

December 31, 2007.

Dividend Policy

We are not required to pay any dividends and have not declared or paid any cash dividends on our common

stock. We intend to continue to retain earnings for use in the operation and expansion of our business and

therefore do not anticipate payment of any cash dividends on our common stock in the foreseeable future.

Securities Authorized for Issuance Under Equity Compensation Plans

See Item 12. “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder

Matters” for information regarding securities authorized for issuance under our equity compensation plans.

24