Lumber Liquidators 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

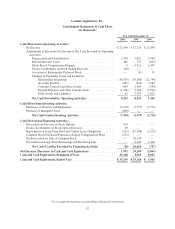

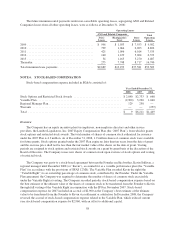

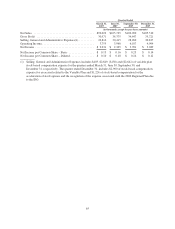

The future minimum rental payments under non-cancellable operating leases, segregating ANO and Related

Companies leases from all other operating leases, were as follows at December 31, 2008:

Operating Leases

ANO and Related Companies

Store

Leases

Total

Operating

Leases

Store

Leases

Headquarters

Lease

2009 ............................................. $ 996 $ 1,033 $ 7,553 $ 9,582

2010 ............................................. 799 1,064 6,963 8,826

2011 ............................................. 425 1,096 6,014 7,535

2012 ............................................. 140 1,129 5,064 6,333

2013 ............................................. 54 1,163 3,270 4,487

Thereafter ........................................ 275 7,748 8,717 16,740

Total minimum lease payments ........................ $2,689 $13,233 $37,581 $53,503

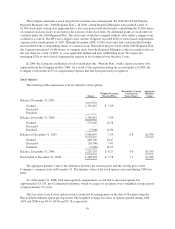

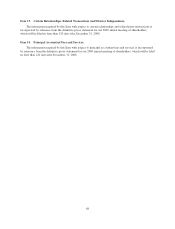

NOTE 6. STOCK-BASED COMPENSATION

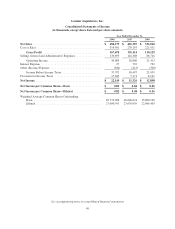

Stock-based compensation expense included in SG&A consisted of:

Year Ended December 31,

2008 2007 2006

Stock Options and Restricted Stock Awards ................................ $2,840 $2,733 $ 668

Variable Plan ......................................................... (2,960) 3,220 1,040

Regional Manager Plan ................................................. 129 258 —

Warrants ............................................................ — — (259)

Total ............................................................... $ 9 $6,211 $1,449

Overview

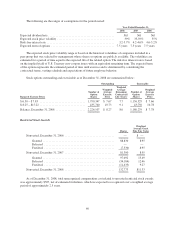

The Company has an equity incentive plan for employees, non-employee directors and other service

providers, the Lumber Liquidators, Inc. 2007 Equity Compensation Plan (the “2007 Plan”), from which it grants

stock options and restricted stock awards. The total number of shares of common stock authorized for issuance

under the 2007 Plan is 4.3 million. As of December 31, 2008, 1.9 million shares of common stock were available

for future grants. Stock options granted under the 2007 Plan expire no later than ten years from the date of grant

and the exercise price shall not be less than the fair market value of the shares on the date of grant. Vesting

periods are assigned to stock options and restricted stock awards on a grant by grant basis at the discretion of the

Board of Directors. The Company issues new shares of common stock upon exercise of stock options and vesting

of restricted stock.

The Company was party to a stock-based agreement between the Founder and his brother, Kevin Sullivan, a

regional manager until December 2008 (or “Kevin”), accounted for as a variable performance plan (the “Variable

Plan”) in accordance with the provisions of SFAS 123(R). The Variable Plan awarded Kevin the right (the

“Variable Right”) to an ownership percentage of common stock, contributed by the Founder. Under the Variable

Plan agreement, the Company was required to determine the number of shares of common stock exercisable

under the Variable Right at vesting. The Company recorded periodic stock-based compensation expense based on

the best estimate of the ultimate value of the shares of common stock to be transferred from the Founder to Kevin

through full vesting of the Variable Right in conjunction with the IPO in November 2007. Stock-based

compensation expense for 2007 included an accrual of $2,960 as the Company’s best estimate of the ultimate

value to be transferred from the Founder to Kevin via settlement or arbitration. In December 2008, the Company

reversed the accrual of stock-based compensation expense related to the Variable Plan, which reduced current

year stock-based compensation expense by $2,960, with an offset to additional capital.

58