Lumber Liquidators 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

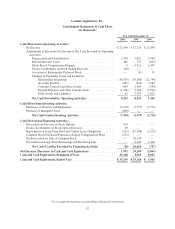

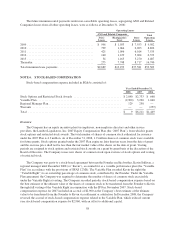

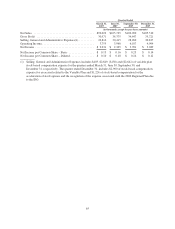

The reconciliation of significant differences between income tax expense (benefit) applying the federal

statutory rate of 35% and the actual income tax expense (benefit) at the effective rate are as follows:

Year Ended December 31,

2008 2007 2006

Income Tax Expense at Federal Statutory Rate ....... $13,227 35.0% $6,474 35.0% $7,370 35.0%

Increases (Decreases):

State Income Taxes, Net of Federal Income Tax

Benefit ................................. 1,939 5.1% 838 4.5% 855 4.1%

Reduction of Deferred Tax Benefit Associated

with the Variable Plan ..................... 678 1.7% — 0.0% — 0.0%

Excess Tax Benefit on Stock Option Exercises . . . (40) 0.0% — 0.0% — 0.0%

Other .................................... (161) (0.4)% (141) (0.7)% (65) (0.3)%

Total ........................................ $15,643 41.4% $7,171 38.8% $8,161 38.8%

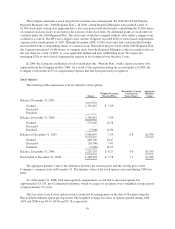

Pursuant to the Variable Plan, the Variable Right fully vested in conjunction with the IPO and was exercised

on February 1, 2008. At that time, the Company had no excess tax deductions from previous stock-based awards,

and therefore recognized additional tax expense related to the non-deductible portion of the Variable Plan’s

cumulative compensation costs. This additional income tax expense was the result of a decrease in the fair value

of the Vested Shares from the vest date to the exercise date. Subsequent stock option exercises during 2008

resulted in an excess tax benefit that reduced income tax expense.

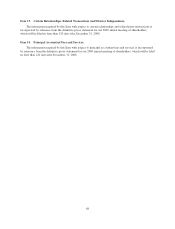

The tax effects of temporary differences that result in significant portions of the deferred tax accounts are as

follows:

December 31,

2008 2007

Deferred Tax Liabilities:

Prepaid Expenses ................................................ $ 337 $ 393

Depreciation and Amortization ..................................... 885 333

Total Deferred Tax Liabilities .......................................... 1,222 726

Deferred Tax Assets:

Stock-Based Compensation Expense ................................ 2,552 2,565

Reserves ...................................................... 1,712 919

Employee Benefits .............................................. 865 605

Other ......................................................... 393 384

Total Deferred Tax Assets ............................................. 5,522 4,473

Net Deferred Tax Asset ............................................... $4,300 $3,747

The Company made income tax payments of $15,112, $7,383 and $6,989 in 2008, 2007 and 2006,

respectively.

The Company files income tax returns with the U.S. federal government and various state jurisdictions. In

the normal course of business, we are subject to examination by federal and state taxing authorities.

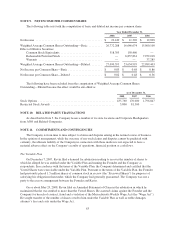

NOTE 8. PROFIT SHARING PLAN

The Company maintains a profit-sharing plan, qualified under Section 401(k) of the Internal Revenue Code,

for all eligible employees. Employees are eligible to participate following the completion of one year of service

and attainment of age 21. The Company matches 50% of employee contributions up to 6% of eligible

compensation. The Company’s matching contributions, included in SG&A, totaled $344, $231 and $160 in 2008,

2007 and 2006, respectively.

62