Lumber Liquidators 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

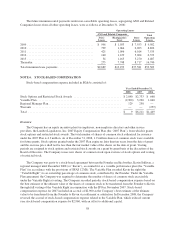

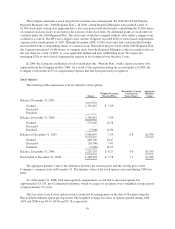

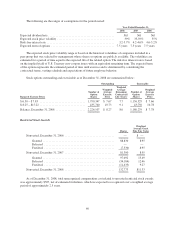

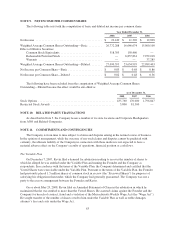

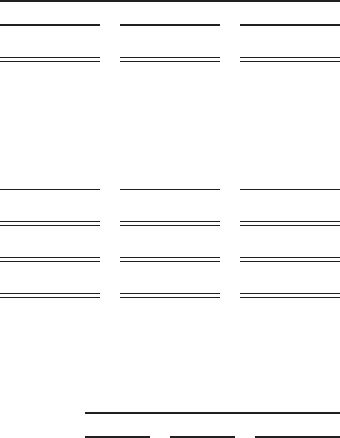

NOTE 9. NET INCOME PER COMMON SHARE

The following table sets forth the computation of basic and diluted net income per common share:

Year Ended December 31,

2008 2007 2006

Net Income ............................................. $ 22,149 $ 11,326 $ 12,898

Weighted Average Common Shares Outstanding—Basic ......... 26,772,288 16,646,674 15,000,100

Effect of Dilutive Securities:

Common Stock Equivalents ............................ 318,305 150,460 —

Redeemable Preferred Stock ............................ — 6,837,861 7,952,018

Warrants ........................................... — — 37,285

Weighted Average Common Shares Outstanding—Diluted ........ 27,090,593 23,634,995 22,989,403

Net Income per Common Share—Basic ....................... $ 0.83 $ 0.68 $ 0.86

Net Income per Common Share—Diluted ..................... $ 0.82 $ 0.48 $ 0.56

The following have been excluded from the computation of Weighted Average Common Shares

Outstanding—Diluted because the effect would be anti-dilutive:

As of December 31,

2008 2007 2006

Stock Options .................................................... 435,760 170,000 1,796,847

Restricted Stock Awards ........................................... 5,800 81,300 —

NOTE 10. RELATED PARTY TRANSACTIONS

As described in Note 5, the Company leases a number of its store locations and Corporate Headquarters

from ANO and Related Companies.

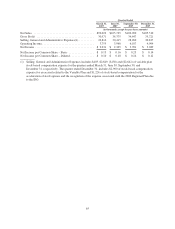

NOTE 11. COMMITMENTS AND CONTINGENCIES

The Company is from time to time subject to claims and disputes arising in the normal course of business.

In the opinion of management, while the outcome of any such claims and disputes cannot be predicted with

certainty, the ultimate liability of the Company in connection with these matters is not expected to have a

material adverse effect on the Company’s results of operations, financial position or cash flows.

The Variable Plan

On December 7, 2007, Kevin filed a demand for arbitration seeking to recover the number of shares to

which he alleged he was entitled under the Variable Plan and naming the Founder and the Company as

respondents. In accordance with the terms of the Variable Plan, the Company determined and certified that the

Vested Shares were exercisable under the Variable Plan. Pursuant to the terms of the Variable Plan, the Founder

had previously placed 1.5 million shares of common stock in escrow (the “Escrowed Shares”) for purposes of

satisfying his obligations thereunder, which the Company had generally guaranteed. The Company was not a

party to the escrow arrangement between the Founder and Kevin.

On or about May 29, 2008, Kevin filed an Amended Statement of Claim in the arbitration in which he

maintained that he was entitled to more than the Vested Shares. He asserted claims against the Founder and the

Company for breach of contract, fraud and a violation of the Massachusetts Weekly Wage Act (the “Wage Act”).

He sought transfer of the number of shares owed to him under the Variable Plan as well as treble damages,

attorney’s fees and costs under the Wage Act.

63