Lumber Liquidators 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

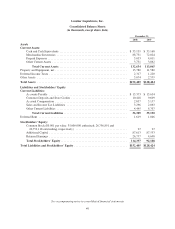

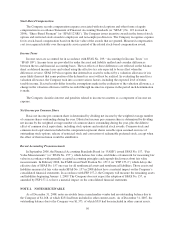

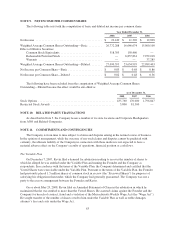

NOTE 3. PROPERTY AND EQUIPMENT

Property and equipment consisted of:

December 31,

2008 2007

Vehicles ......................................................... $ 8,984 $ 9,045

Finishing Equipment ............................................... 3,432 3,171

Office Equipment and Other ......................................... 6,986 5,029

Store Fixtures .................................................... 4,494 2,413

Leasehold Improvements ........................................... 3,997 1,736

27,893 21,394

Less: Accumulated Depreciation and Amortization ....................... 14,113 9,814

Property and Equipment, net ..................................... $13,780 $11,580

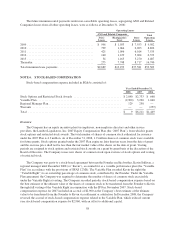

NOTE 4. REVOLVING CREDIT AGREEMENT

A revolving credit agreement (the “Revolver”) providing for borrowings up to $25,000 is available to the

Company through expiration on August 10, 2012. During 2008, the Company did not borrow against the

Revolver and at December 31, 2008, there were no outstanding commitments under letters of credit. At

December 31, 2007, the Company had outstanding letters of credit of $262 and $24,738 was available to borrow.

The Revolver is primarily available to fund inventory purchases, including the support of up to $5,000 for letters

of credit, and for general operations. The Revolver is secured by the Company’s inventory, has no mandated

payment provisions and the Company pays a fee of 0.125% per annum, subject to adjustment based on certain

financial performance criteria, on any unused portion of the Revolver. Amounts outstanding under the Revolver

would be subject to an interest rate of LIBOR (reset on the 10th of the month) + 0.50%, subject to adjustment

based on certain financial performance criteria. The Revolver has certain defined covenants and restrictions,

including the maintenance of certain defined financial ratios. The Company is in compliance with these financial

covenants at December 31, 2008.

Interest payments on capital leases totaled $4 in 2008, and interest payments on capital leases and previous

borrowing totaled $679 and $672 in 2007 and 2006, respectively.

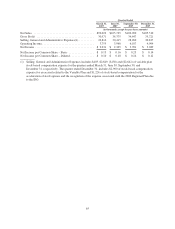

NOTE 5. LEASES

The Company leases all store locations, the Corporate Headquarters and certain equipment. The store

location leases are operating leases and generally have five-year base periods with multiple five-year renewal

periods.

The Founder is also the sole owner of ANO LLC, DORA Real Estate Company, LLC and Wood on Wood

Road, Inc., and he has a 50% membership interest in BMT Holdings, LLC (collectively, “ANO and Related

Companies”). As of December 31, 2008, 2007 and 2006, the Company leased 26 of its locations from ANO and

Related Companies representing 17.3%, 22.4% and 28.6% of the total number of store leases in operation,

respectively. In addition, the Company leases the Corporate Headquarters from ANO LLC under an operating

lease with a base period through December 31, 2019.

Rental expense for 2008, 2007 and 2006 was $9,276, $6,853 and $5,213, respectively, with rental expense

attributable to ANO and Related Companies of $2,505, $2,529 and $2,261, respectively.

57