Lumber Liquidators 2008 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2008 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Merchandise Inventories

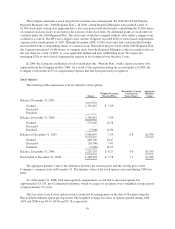

The Company values merchandise inventories at the lower of cost or market. Merchandise cost is

determined using the average cost method. All of the hardwood flooring purchased from vendors is either

prefinished or unfinished, and in immediate saleable form. The Company adds the finish to, and boxes, various

species of unfinished product, to produce certain proprietary products, primarily Bellawood, at its finishing

facility. These finishing and boxing costs are included in the average unit cost of related merchandise inventory.

The Company maintains an inventory reserve for loss or obsolescence, based on historical results and current

sales trends. This reserve was $516 and $644 at December 31, 2008 and 2007, respectively.

Impairment of Long-Lived Assets

The Company evaluates potential impairment losses on long-lived assets used in operations when events

and circumstances indicate that the assets may be impaired, and the undiscounted cash flows estimated to be

generated by those assets are less than the carrying amounts of those assets. If impairment exists and the

undiscounted cash flows estimated to be generated by those assets are less than the carrying amount of those

assets, an impairment loss is recorded based on the difference between the carrying value and fair value of the

assets. No impairment charges were recognized in 2008, 2007 or 2006.

Goodwill and Other Indefinite-Lived Intangibles

Other assets include $1,050 of goodwill and $800 for an indefinite-lived intangible asset due to the 2008

purchase of the phone number 1-800-HARDWOOD and related internet domain names. The Company evaluates

these assets for impairment on an annual basis, or whenever events or changes in circumstance indicate that the

carrying value may be impaired. Based on the analysis performed, the Company has concluded that no

impairment in the value of these assets has occurred.

Self Insurance

Effective June 1, 2008, the Company self-insures for certain employee health benefit claims. Management

estimates a liability for aggregate losses below stop-loss coverage limits based on estimates of the ultimate costs

to be incurred to settle known claims and claims not reported as of the balance sheet date. The estimated liability

is not discounted and is based on a number of assumptions and factors including historical trends, actuarial

assumptions, and economic conditions. This liability could be affected if future occurrences and claims differ

from these assumptions and historical trends. As of December 31, 2008, an accrual of $281 related to estimated

claims was included in other current liabilities.

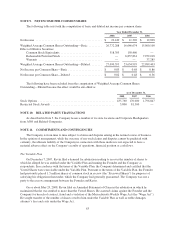

Recognition of Net Sales

The Company recognizes net sales for products purchased at the time the customer takes possession of the

merchandise. Service revenue, primarily freight charges for in-home delivery, is recognized when the service has

been rendered. The Company reports revenue net of sales and use taxes collected from customers and remitted to

governmental taxing authorities. Net sales are reduced by an allowance for anticipated sales returns based on

historical and current sales trends and experience. The sales returns allowance and related changes were not

significant for 2008, 2007 or 2006.

The Company generally requires customers to pay a deposit, equal to approximately 50% of the retail sales

value, when purchasing merchandise inventories not regularly carried in a given store location, or not currently in

stock. These deposits are included in customer deposits and store credits until the customer takes possession of

the merchandise.

54