Lumber Liquidators 2008 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2008 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Lumber Liquidators, Inc.

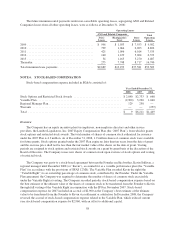

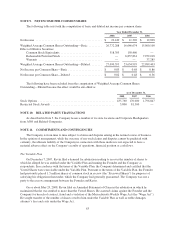

Notes to Consolidated Financial Statements

(amounts in thousands, except share data and per share amounts)

NOTE 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Nature of Business

Lumber Liquidators, Inc. (the “Company”) is a multi-channel specialty retailer of hardwood flooring, and

hardwood flooring enhancements and accessories, operating as a single business segment. The Company offers

an extensive assortment of exotic and domestic hardwood species, engineered hardwoods, and laminates direct to

the consumer. The Company also features the renewable flooring products, bamboo and cork, and provides a

wide selection of flooring enhancements and accessories, including moldings, noise-reducing underlay and

adhesives. These products are primarily sold under the Company’s private label brands, including the premium

Bellawood brand floors. The Company sells primarily to homeowners or to contractors on behalf of homeowners

through a network of 150 store locations in primary or secondary metropolitan areas in 44 states. In addition to

the store locations, the Company’s products may be ordered, and customer questions/concerns addressed,

through both our call center in Toano, Virginia, and our website, www.lumberliquidators.com. The Company

finishes the majority of the Bellawood products in Toano, Virginia, which along with the call center, corporate

offices, and finishing and distribution facility represent the “Corporate Headquarters.”

Organization and Basis of Financial Statement Presentation

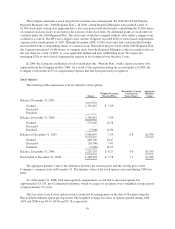

The Company was organized in 1994 as a Massachusetts corporation, and in August 2007, the Company

was reincorporated in Delaware. In November 2007, the Company completed its offering of 3,800,000 shares of

common stock in an initial public offering at a per share price of $11.00, receiving net proceeds of approximately

$36,150 (the “IPO”). The founder and current chairman of the Board (the “Founder”) and a private investment

group sold an additional 6,200,000 shares of common stock in the IPO.

The consolidated financial statements of the Company include the accounts of its wholly owned subsidiary,

Lumber Liquidators Leasing, LLC. All significant intercompany transactions have been eliminated in

consolidation. The prior year balance sheet reflects the segregation of deferred rent and sales and income tax

liabilities from other current liabilities.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the

United States requires management to make estimates and assumptions that affect the amounts reported in the

consolidated financial statements and accompanying notes. Actual results could differ from those estimates.

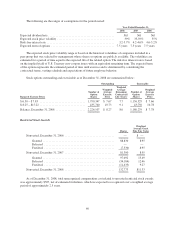

Cash and Cash Equivalents

The Company considers all highly liquid investments with a maturity date of three months or less when

purchased to be cash equivalents. The Company accepts a range of debit and credit cards, and these transactions

are generally transmitted to a bank for reimbursement within 24 hours. The payments due from the banks for

these debit and credit card transactions are generally received, or settle, within 24-48 hours of the transmission

date. The Company considers all debit and credit card transactions that settle in less than seven days to be cash

and cash equivalents. Amounts due from the banks for these transactions classified as cash and cash equivalents

totaled $2,889 and $2,065 at December 31, 2008 and 2007, respectively.

Fair Value of Financial Instruments

The carrying amounts of financial instruments such as cash and cash equivalents, notes receivable and

accounts payable, and other liabilities approximate fair value because of the short-term nature of these items.

53