Lumber Liquidators 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

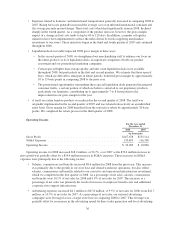

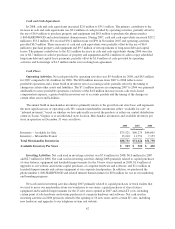

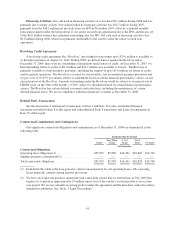

Total stock-based compensation expenses included in SG&A for 2008, 2007 and 2006 were:

2008 2007 2006

Variable Plan ......................................................... $(2,960) $3,220 $1,040

Stock Options, Restricted Stock and Other ................................. 2,969 1,756 409

Acceleration of Stock Options/Regional Manager Plan ........................ — 1,235 —

Total ............................................................... $ 9 $6,211 $1,449

Variable Plan. We were party to a stock-based agreement between the Founder and his brother, Kevin

Sullivan, a regional manager until December 2008 (or “Kevin”), accounted for as a variable performance plan

(the “Variable Plan”) in accordance with the provisions of SFAS 123(R). The Variable Plan awarded Kevin the

right (the “Variable Right”) to an ownership percentage of common stock, contributed by the Founder. The

Variable Plan was originally established in 1998, and through an amendment in 2005, the Variable Right was

established to award Kevin a right to purchase an ownership position in common stock from the Founder for his

service to the Company. The ownership position was defined as a fixed percentage of 2.5% of common stock on

a fully diluted basis, as defined in the agreement, plus an additional ownership percentage based on certain

performance criteria, primarily a comparison of the net income of the region under Kevin’s management to total

Company net income on a trailing twelve-month basis.

The Variable Plan provided for a cash settlement of the Variable Right at a defined, performance based,

value through put-call provisions, executed by the Founder or Kevin, if an IPO or sale event, as defined, had not

taken place prior to February 1, 2008. The Founder was liable for the cash payment, and we guaranteed his

performance. Pursuant to the terms of the Variable Plan, the Founder had previously placed 1.5 million shares of

common stock in escrow for purposes of satisfying his obligations thereunder, which obligations we had

generally guaranteed.

The Variable Right fully vested and became exercisable in connection with the IPO and all cash settlement

provisions via put-call rights terminated. In accordance with the terms of the Variable Plan, we calculated that

853,853 shares of common stock had vested and were exercisable under the Variable Right. Cumulative stock-

based compensation expense related to the Variable Plan was determined utilizing the Vested Shares and the $11

per share IPO price to adjust the stock compensation liability and in the fourth quarter of 2007, the stock

compensation liability was reclassified to additional capital in accordance with the provisions of SFAS 123(R).

The Variable Right was exercised on February 1, 2008.

Kevin filed a demand for arbitration and an Amended Statement of Claim where he maintained that he was

entitled to, among other things, more than the Vested Shares. As a result, during 2007 we recorded an additional

$2.96 million of stock-based compensation expense related to the Variable Plan, as our best estimate of the

ultimate value of incremental shares (above the Vested Shares) that may have been delivered to Kevin via

settlement or arbitration.

In November 2008, the parties completed the arbitration proceeding, and in a ruling dated December 1,

2008, the arbitrator determined that Kevin was entitled only to the Vested Shares. We reversed the additional

accrual of stock-based compensation expense related to the Variable Plan, which reduced current year stock-

based compensation expense by $2.96 million, with an offset to additional capital. During 2008, the legal,

professional and other fees associated with this matter cost us $0.7 million, net of insurance proceeds.

Stock Options, Restricted Stock and Other Equity Equivalents.As described in Note 6 to the consolidated

financial statements included in Item 8 of this report, we maintain an equity incentive plan for employees,

non-employee directors and other service providers, the Lumber Liquidators, Inc. 2007 Equity Compensation

Plan, from which we expect to continue to grant stock options and restricted share awards, primarily on an annual

basis.

33