LinkedIn 2013 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2013 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

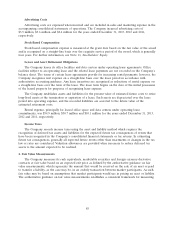

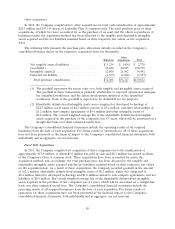

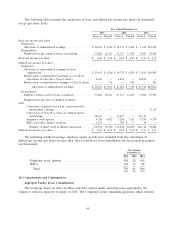

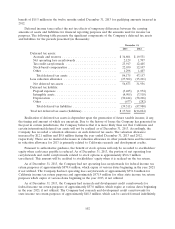

operating expenses, under non-cancelable operating leases for office facilities and data centers having

initial terms in excess of one year as of December 31, 2013, are as follows (in thousands):

Operating

Year Ending December 31, Leases(1)

2014 ..................................................... $ 71,126

2015 ..................................................... 95,992

2016 ..................................................... 96,945

2017 ..................................................... 92,853

2018 ..................................................... 83,161

Thereafter ................................................. 525,291

Total minimum lease payments ................................ $965,368

(1) Subsequent to December 31, 2013, the Company leased additional space in New York, New

York. The lease expires in 2026 and aggregate future minimum lease payments for this

facility are approximately $25.6 million.

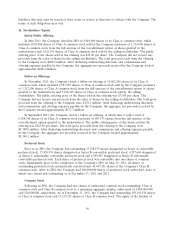

Legal Proceedings

The Company is subject to legal proceedings and litigation arising in the ordinary course of business,

including, but not limited to, certain pending patent and privacy matters, including class action lawsuits, as

well as inquiries, investigations, audits and other regulatory proceedings. Although occasional adverse

decisions or settlements may occur, the Company does not believe that the final disposition of any of

these matters will have a material adverse effect on the business. Certain of these matters include

speculative claims for substantial or indeterminate amounts of damages, and include claims for injunctive

relief. Additionally, the Company’s litigation costs are significant. Other regulatory matters could result in

fines and penalties being assessed against the Company, and it may become subject to mandatory periodic

audits, which would likely increase its regulatory compliance costs. Adverse results of litigation or

regulatory matters could also result in the Company being required to change its business practices, which

could negatively impact its membership and revenue growth.

The Company records a liability when it believes that it is both probable that a loss has been incurred

and the amount can be reasonably estimated. The Company periodically evaluates developments in its

legal matters that could affect the amount of liability that it has previously accrued, if any, and makes

adjustments as appropriate. Significant judgment is required to determine both likelihood of there being,

and the estimated amount of, a loss related to such matters, and the Company’s judgment may be

incorrect. The outcome of any proceeding is not determinable in advance. Until the final resolution of any

such matters that the Company may be required to accrue for, it may be exposed to loss in excess of the

amount accrued, and such amounts could be material.

Indemnifications

In the ordinary course of business, the Company enters into contractual arrangements under which it

agrees to provide indemnification of varying scope and terms to business partners and other parties with

respect to certain matters, including, but not limited to, losses arising out of the Company’s breach of

such agreements and out of intellectual property infringement claims made by third parties. In these

circumstances, payment may be conditional on the other party making a claim pursuant to the procedures

specified in the particular contract. Further, the Company’s obligations under these agreements may be

limited in terms of time and/or amount, and in some instances, it may have recourse against third parties

for certain payments. In addition, the Company has indemnification agreements with certain of its

directors and executive officers that require it, among other things, to indemnify them against certain

95