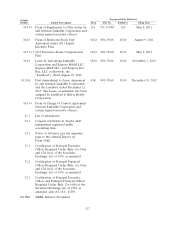

LinkedIn 2013 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2013 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Utilization of the net operating loss carryforwards and credits may be subject to a substantial annual

limitation due to the ownership change limitations provided by the Internal Revenue Code of 1986, as

amended and similar state provisions. The annual limitation may result in the expiration of net operating

losses and credits before utilization. The Company believes an ownership change, as defined under

Section 382 of the Internal Revenue Code, existed in prior years, and has reduced its net operating loss

carryforwards to reflect the limitation.

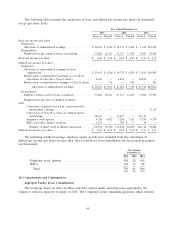

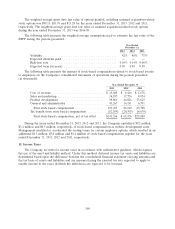

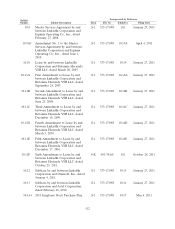

As of December 31, 2013, the Company had approximately $43.7 million in total unrecognized tax

benefits. A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows

(in thousands):

Year Ended

December 31,

2013 2012

Unrecognized tax benefits balance at January 1 ............... $19,344 $10,657

Gross increase for tax positions of prior years ............... 9,482 1,538

Gross increase for tax positions of current year .............. 14,909 7,149

Gross unrecognized tax benefits at December 31 .............. $43,735 $19,344

If the $43.7 million of unrecognized tax benefits as of December 31, 2013 is recognized,

approximately $25.3 million would decrease the effective tax rate in the period in which each of the

benefits is recognized. If the $19.3 million of unrecognized tax benefits as of December 31, 2012 is

recognized, approximately $8.3 million would decrease the effective tax rate in the period in which each of

the benefits is recognized. The remaining amount would be offset by the reversal of related deferred tax

assets on which a valuation allowance is placed. The Company does not expect any material changes to its

unrecognized tax benefits within the next twelve months.

The Company recognizes interest and penalties related to uncertain tax positions in income tax

expense. As of December 31, 2013 and 2012, penalties and interest were immaterial.

The Company files income tax returns in the U.S. federal jurisdiction as well as many U.S. states and

foreign jurisdictions. The tax years 2003 to 2011 remain open to examination by the major jurisdictions in

which the Company is subject to tax. Fiscal years outside the normal statute of limitation remain open to

audit by tax authorities due to tax attributes generated in those early years which have been carried

forward and may be audited in subsequent years when utilized. The Company is currently under audit by

the Internal Revenue Service (‘‘IRS’’) for the 2010 and 2011 tax years. The Company is subject to the

continuous examination of income tax returns by various tax authorities. The Company regularly assesses

the likelihood of adverse outcomes resulting from these examinations to determine the adequacy of the

provision for income taxes. The Company believes that adequate amounts have been reserved for any

adjustments that may ultimately result from these examinations and does not anticipate a significant

impact to the gross unrecognized tax benefits within the next 12 months related to these years.

The Company attributes net revenue and costs and expenses to domestic and foreign components

based on the terms of its agreements with its subsidiaries. The Company does not provide for federal

income taxes on the undistributed earnings of its foreign subsidiaries, as such earnings are to be

reinvested offshore indefinitely. The income tax liability would be insignificant if these earnings were to be

repatriated.

13. Information About Revenue and Geographic Areas

The Company considers operating segments to be components of the Company in which separate

financial information is available that is evaluated regularly by the Company’s chief operating decision

maker in deciding how to allocate resources and in assessing performance. The chief operating decision

103