LinkedIn 2013 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2013 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

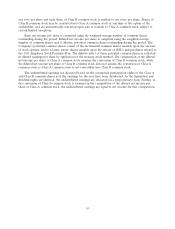

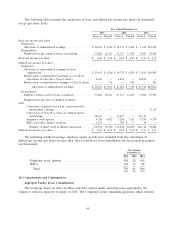

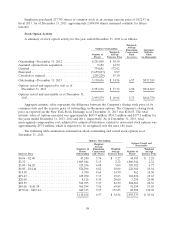

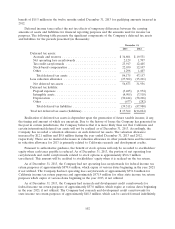

RSU Activity

A summary of RSU activity for the year ended December 31, 2013, is as follows:

Weighted-

Average

Number of Grant Date

Shares Fair Value

Unvested—December 31, 2012 ........................ 3,239,272 $ 94.69

Granted ......................................... 2,313,018 189.75

Released ........................................ (1,154,252) 103.51

Canceled or expired ................................ (349,949) 117.43

Unvested—December 31, 2013 ........................ 4,048,089 $144.53

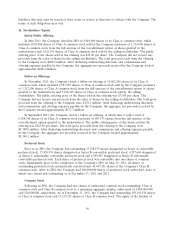

As of December 31, 2013, total unrecognized compensation cost, adjusted for estimated forfeitures,

related to RSUs was approximately $450.1 million, which is expected to be recognized over the next

2.93 years.

Restricted Stock

In connection with Pulse, Slideshare and other acquisitions, the Company issued restricted stock. As

of December 31, 2013, the total unrecognized compensation cost related to restricted stock was

approximately $39.7 million, which is expected to be recognized over the next 2.42 years.

Stock-Based Compensation Expense

The fair value of options granted to employees is estimated on the grant date using the Black-Scholes

option valuation model. This valuation model for stock-based compensation expense requires the

Company to make assumptions and judgments about the variables used in the calculation, including the

fair value of the Company’s common stock, the expected term (the period of time that the options

granted are expected to be outstanding), the volatility of the Company’s common stock, a risk-free interest

rate, and expected dividends. The Company also estimates forfeitures of unvested stock options. To the

extent actual forfeitures differ from the estimates, the difference will be recorded as a cumulative

adjustment in the period estimates are revised. No compensation cost is recorded for options that do not

vest. The Company uses the simplified calculation of expected life described in the SEC’s Staff

Accounting Bulletin No. 107, Share-Based Payment, and volatility for stock options is based on an average

of the historical volatilities of the common stock of several entities with characteristics similar to those of

the Company. The Company will continue to use the simplified method until it has sufficient historical

exercise data to estimate the expected life of the options. The volatility for ESPP is based on the

historical volatility of the Company’s common stock. The risk-free rate is based on the U.S. Treasury yield

curve in effect at the time of grant for periods corresponding with the expected life of the option. The

Company uses an expected dividend yield of zero as it does not anticipate paying any dividends in the

foreseeable future. Expected forfeitures are based on the Company’s historical experience.

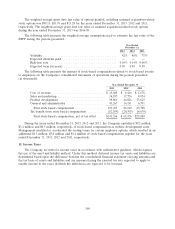

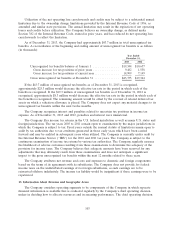

The following table presents the weighted-average assumptions used to estimate the fair value of

options granted during the periods presented, excluding assumed acquisition-related stock options:

Year Ended

December 31,

2013 2012 2011

Volatility .......................................... 54% 54% 55%

Expected dividend yield ............................... — — —

Risk-free rate ...................................... 1.15% 0.95% 2.58%

Expected term (in years) .............................. 6.27 6.08 6.07

99