LinkedIn 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

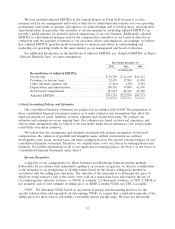

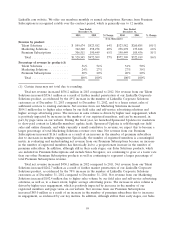

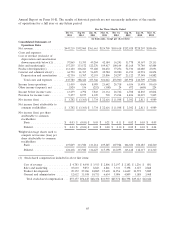

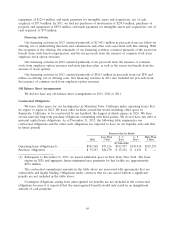

Depreciation and Amortization

Depreciation and amortization expenses primarily consist of depreciation on computer equipment,

software, leasehold improvements, capitalized software development costs and amortization of purchased

intangibles. We expect that depreciation and amortization expenses will increase on an absolute basis and

as a percentage of revenue as we continue to expand our technology and facilities infrastructure.

Year Ended Year Ended

December 31, December 31,

2013 2012 % Change 2012 2011 % Change

($ in thousands)

Depreciation and amortization ......... $134,516 $79,849 68% $79,849 $43,100 85%

Percentage of net revenue ............ 9% 8% 8% 8%

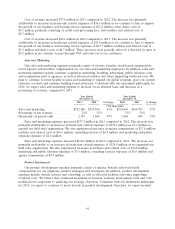

Depreciation and amortization expenses increased $54.7 million in 2013 compared to 2012. The

increase in depreciation expense of $48.1 million was primarily a result of our continued investment in

expanding our technology infrastructure in order to support continued growth in our member base, and to

a lesser extent, increases in amortization of acquired intangible assets of $6.5 million.

Depreciation and amortization expenses increased $36.7 million in 2012 compared to 2011. The

increase in depreciation expense of $30.5 million was primarily a result of our continued investment in

expanding our technology infrastructure in order to support continued growth in our member base, and to

a lesser extent, increases in amortization of acquired intangible assets of $6.2 million.

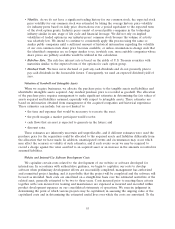

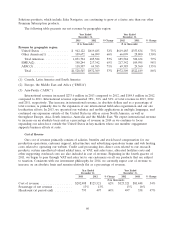

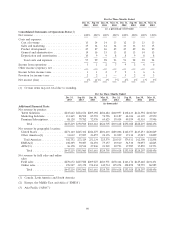

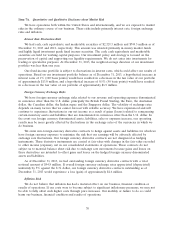

Other Income (Expense), Net

Other income (expense), net consists primarily of the interest income earned on our investments and

foreign exchange gains and losses. Hedging strategies that we have implemented or may implement to

mitigate this risk may not eliminate our exposure to foreign exchange fluctuations.

Year Ended December 31,

2013 2012 2011

(in thousands)

Interest income ............................................. $2,895 $1,025 $ 169

Net loss on foreign exchange and foreign currency derivative contracts ..... (1,626) (672) (2,965)

Net realized gain on sales of marketable securities .................... 127 60 6

Other non-operating income (expense), net ......................... 20 (161) (113)

Total other income (expense), net ............................... $1,416 $ 252 $(2,903)

Other income (expense), net increased $1.2 million in 2013 compared to 2012, and $3.2 million in

2012 compared to 2011 primarily due to interest earned on higher investment balances, offset by foreign

currency exchange losses.

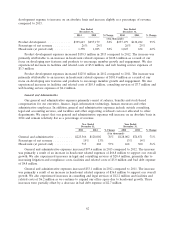

Provision for Income Taxes

We recognize the tax benefit from an uncertain tax position only if it is more likely than not the tax

position will be sustained on examination by the taxing authorities, based on the technical merits of the

position. The tax benefits recognized in the financial statements from such positions are then measured

based on the largest benefit that has a greater than 50% likelihood of being realized upon settlement. For

63