LinkedIn 2013 Annual Report Download - page 83

Download and view the complete annual report

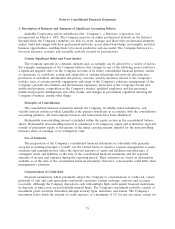

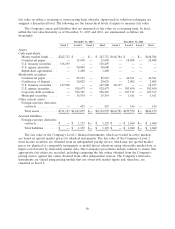

Please find page 83 of the 2013 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fair Value of Financial Instruments

The Company applies fair value accounting for all financial assets and liabilities and non-financial

assets and liabilities that are recognized or disclosed at fair value in the financial statements on a

recurring basis. Fair value is based on an expected exit price as defined by the authoritative guidance on

fair value measurements, which represents the amount that would be received on the sale of an asset or

paid to transfer a liability, as the case may be, in an orderly transaction between market participants. As

such, fair value may be based on assumptions that market participants would use in pricing an asset or

liability. The authoritative guidance on fair value measurements establishes a consistent framework for

measuring fair value on either a recurring or nonrecurring basis whereby inputs, used in valuation

techniques, are assigned a hierarchical level. The following are the hierarchical levels of inputs to measure

fair value:

•Level 1: Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities

in active markets.

•Level 2: Inputs reflect: quoted prices for identical assets or liabilities in markets that are not active;

quoted prices for similar assets or liabilities in active markets; inputs other than quoted prices that

are observable for the assets or liabilities; or inputs that are derived principally from or

corroborated by observable market data by correlation or other means.

•Level 3: Unobservable inputs reflecting the Company’s assumptions incorporated in valuation

techniques used to determine fair value. These assumptions are required to be consistent with

market participant assumptions that are reasonably available.

The valuation techniques used to measure the fair value of money market funds and treasury

securities were derived from quoted market prices for identical instruments in active markets. The

valuation technique used to measure the fair value of the Company’s Level 2 fixed income securities are

obtained from an independent pricing service, which may use quoted market prices for identical or

comparable instruments or model-driven valuation using significant inputs derived from or corroborated

by observable market data. The Company’s procedures include controls to ensure that appropriate fair

values are recorded, including comparing the fair values obtained from the Company’s pricing service

against fair values obtained from another independent source.

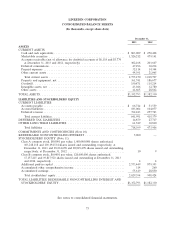

Deferred Commissions

Deferred commissions are the incremental costs that are directly associated with non-cancelable

subscription contracts primarily related to sales of the Company’s Talent Solutions products. Deferred

commissions consist of sales commissions paid to the Company’s direct sales representatives and certain

third-party agencies and are deferred and amortized over the non-cancelable terms of the related

customer contracts, which are generally 12 months. The commission payments are generally paid in full

the month after the customer contract is signed. The deferred commission amounts are recoverable

through future revenue streams under the non-cancelable customer contracts. The Company believes the

commission charges are so closely related to the revenue from the non-cancelable customer contracts that

they should be recorded as an asset and charged to expense over the same period that the subscription

revenue is recognized. Short-term deferred commissions are included in deferred commissions while

long-term deferred commissions are included in other assets in the accompanying consolidated balance

sheets. The amortization of deferred commissions is included in sales and marketing expense in the

accompanying consolidated statements of operations.

Derivative Financial Instruments

The Company enters into foreign currency derivative contracts with financial institutions to reduce

the risk that its cash flows and earnings will be adversely affected by foreign currency exchange rate

81