LinkedIn 2013 Annual Report Download - page 107

Download and view the complete annual report

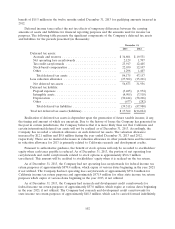

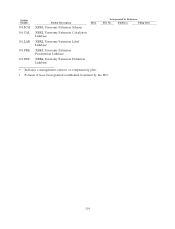

Please find page 107 of the 2013 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.14. Subsequent Events

In January 2014, the Company leased additional space in New York, New York. The lease expires in

2026 and aggregate future minimum lease payments for this facility are approximately $25.6 million.

In February 2014, the Company entered into a definitive agreement to acquire Bright Media

Corporation (‘‘Bright’’), a job search site that allows users to search for jobs, find connections at

companies, and locate job openings that best fit their experience. The transaction was valued at

approximately $120.0 million as of the execution of the definitive agreement. Approximately 73% of the

consideration is expected to be issued as equity consideration, and the remaining 27% is expected to be

issued as cash consideration. The final number of shares of the Company’s Class A common stock and the

final amount of cash to be issued in connection with the acquisition is subject to adjustment based on

(i) purchase price adjustment provisions, (ii) continuing service obligations to the Company of certain

stockholders of Bright, (iii) indemnification obligations of Bright stockholders after the closing of the

acquisition, and (iv) certain elections made by the stockholders of Bright. For accounting purposes, the

equity consideration will be valued based on the closing price of the Company’s Class A common stock as

reported by the NYSE on the closing of the acquisition, and is therefore subject to change. The

transaction is expected to close in the first quarter of 2014.

105