LinkedIn 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

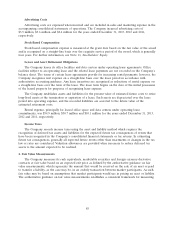

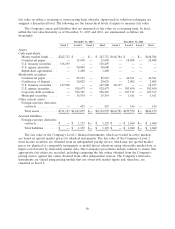

fair value on either a recurring or nonrecurring basis, whereby, inputs used in valuation techniques are

assigned a hierarchical level. The following are the hierarchical levels of inputs to measure fair value:

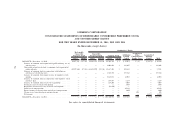

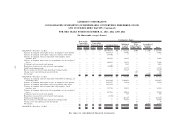

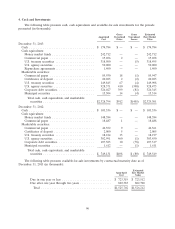

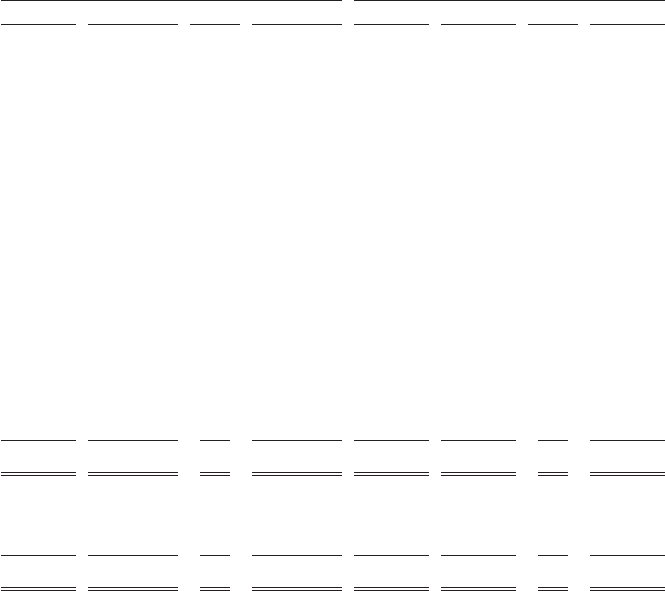

The Company’s assets and liabilities that are measured at fair value on a recurring basis, by level,

within the fair value hierarchy as of December 31, 2013 and 2012, are summarized as follows (in

thousands):

December 31, 2013 December 31, 2012

Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total

Assets:

Cash equivalents:

Money market funds ..... $242,712 $ — $— $ 242,712 $148,384 $ — $— $148,384

Commercial paper ...... — 15,698 — 15,698 — 18,488 — 18,488

U.S. treasury securities . . . 318,495 — — 318,495 — — — —

U.S. agency securities .... — 50,000 — 50,000 — — — —

Repurchase agreements . . . — 1,400 — 1,400 — — — —

Marketable securities:

Commercial paper ...... — 85,947 — 85,947 — 46,361 — 46,361

Certificates of deposit .... — 20,025 — 20,025 — 2,005 — 2,005

U.S. treasury securities . . . 149,908 — — 149,908 18,197 — — 18,197

U.S. agency securities .... — 928,473 — 928,473 — 303,450 — 303,450

Corporate debt securities . — 326,345 — 326,345 — 107,517 — 107,517

Municipal securities ..... — 15,514 — 15,514 — 1,611 — 1,611

Other current assets:

Foreign currency derivative

contracts ............ — 453 — 453 — 146 — 146

Total assets .......... $711,115 $1,443,855 $— $2,154,970 $166,581 $479,578 $— $646,159

Accrued liabilities:

Foreign currency derivative

contracts ............ $ — $ 1,129 $— $ 1,129 $ — $ 1,040 $— $ 1,040

Total liabilities ........ $ — $ 1,129 $— $ 1,129 $ — $ 1,040 $— $ 1,040

The fair value of the Company’s Level 1 financial instruments, which are traded in active markets,

are based on quoted market prices for identical instruments. The fair value of the Company’s Level 2

fixed income securities are obtained from an independent pricing service, which may use quoted market

prices for identical or comparable instruments or model driven valuations using observable market data or

inputs corroborated by observable market data. The Company’s procedures include controls to ensure that

appropriate fair values are recorded, including comparing the fair values obtained from the Company’s

pricing service against fair values obtained from other independent sources. The Company’s derivative

instruments are valued using pricing models that use observable market inputs and, therefore, are

classified as Level 2.

86