LinkedIn 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

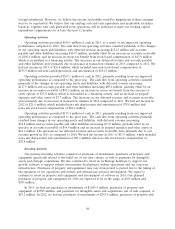

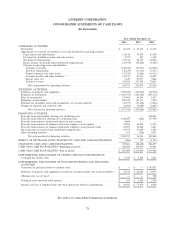

equipment of $125.4 million, and made payments for intangible assets and acquisitions, net of cash

acquired, of $57.0 million. In 2011, we had net purchases of investments of $239.4 million, purchases of

property and equipment of $89.0 million, and made payments for intangible assets and acquisitions, net of

cash acquired, of $7.4 million.

Financing Activities

Our financing activities in 2013 consisted primarily of $1,348.1 million in proceeds from our follow-on

offering, net of underwriting discounts and commissions and other costs associated with this offering. With

the exception of the offering, the remainder of our financing activities consisted primarily of the excess tax

benefit from stock-based compensation, and the net proceeds from the issuance of common stock from

employee stock option exercises.

Our financing activities in 2012 consisted primarily of net proceeds from the issuance of common

stock from employee option exercises and stock purchase plan, as well as the excess tax benefit from the

exercise of stock options.

Our financing activities in 2011 consisted primarily of $426.5 million in proceeds from our IPO and

follow-on offering, net of offering costs. Our financing activities in 2011 also included net proceeds from

the issuance of common stock from employee option exercises.

Off Balance Sheet Arrangements

We did not have any off balance sheet arrangements in 2013, 2012 or 2011.

Contractual Obligations

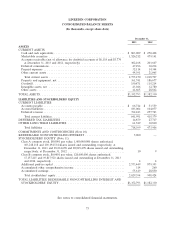

We lease office space for our headquarters in Mountain View, California under operating leases that

we expect to expire in 2023. We lease other facilities around the world, including office space in

Sunnyvale, California, to be constructed by our landlord, the longest of which expires in 2026. We have

several material long-term purchase obligations outstanding with third parties. We do not have any debt or

material capital lease obligations. As of December 31, 2013, the following table summarizes our

contractual obligations and the effect such obligations are expected to have on our liquidity and cash flow

in future periods:

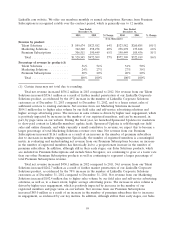

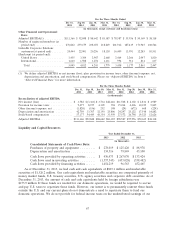

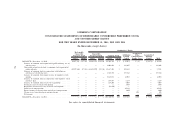

Payments Due by Period

Less Than 1 - 3 3 - 5 More Than

Total 1 Year Years Years 5 Years

(in thousands)

Operating lease obligations(1) .............. $965,368 $71,126 $192,937 $176,014 $525,291

Purchase obligations ..................... $ 76,347 $46,270 $ 25,434 $ 4,643 $ —

(1) Subsequent to December 31, 2013, we leased additional space in New York, New York. The lease

expires in 2026 and aggregate future minimum lease payments for this facility are approximately

$25.6 million.

The contractual commitment amounts in the table above are associated with agreements that are

enforceable and legally binding. Obligations under contracts that we can cancel without a significant

penalty are not included in the table above.

Contingent obligations arising from unrecognized tax benefits are not included in the contractual

obligations because it is expected that the unrecognized benefits would only result in an insignificant

amount of cash payments.

69