LinkedIn 2013 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2013 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

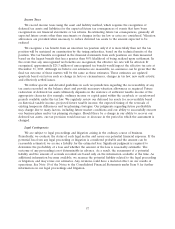

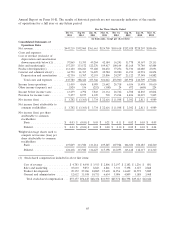

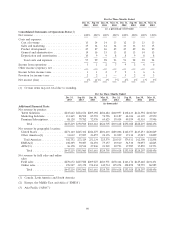

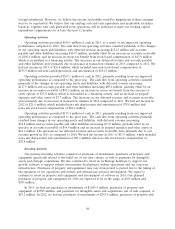

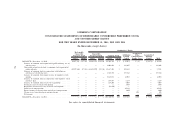

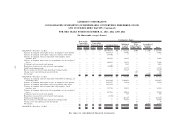

For the Three Months Ended

Dec 31, Sep 30, Jun 30, Mar 31, Dec 31, Sep 30, Jun 30, Mar 31,

2013 2013 2013 2013 2012 2012 2012 2012

(in thousands, except customer and headcount data)

Other Financial and Operational

Data:

Adjusted EBITDA(1) ........... $111,366 $ 92,848 $ 88,642 $ 83,387 $ 78,587 $ 55,956 $ 50,369 $ 38,118

Number of registered members (at

period end) ................ 276,842 259,179 238,072 218,269 201,912 187,419 173,945 160,566

LinkedIn Corporate Solutions

customers (at period end) ....... 24,444 22,001 20,256 18,138 16,409 13,991 12,283 10,531

Headcount (at period end):

United States ............... 3,435 3,304 2,967 2,668 2,464 2,266 2,047 1,810

International ................ 1,610 1,508 1,274 1,111 994 911 814 637

Total ................... 5,045 4,812 4,241 3,779 3,458 3,177 2,861 2,447

(1) We define adjusted EBITDA as net income (loss), plus: provision for income taxes, other (income) expense, net,

depreciation and amortization, and stock-based compensation. Please see ‘‘Adjusted EBITDA’’ in Item 6

‘‘Selected Financial Data’’ for more information.

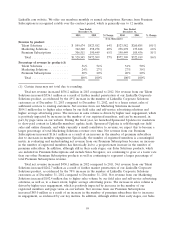

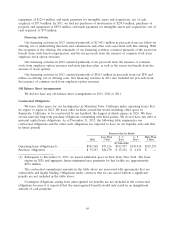

For the Three Months Ended

Dec 31, Sep 30, Jun 30, Mar 31, Dec 31, Sep 30, Jun 30, Mar 31,

2013 2013 2013 2013 2012 2012 2012 2012

(in thousands)

Reconciliation of adjusted EBITDA:

Net income (loss) ................... $ 3,782 $(3,363) $ 3,734 $22,616 $11,508 $ 2,302 $ 2,811 $ 4,989

Provision for income taxes ............. 9,477 8,155 4,109 718 15,234 4,406 10,019 5,845

Other (income) expense, net ............ (1,820) (156) 252 308 (24) (672) 668 (224)

Depreciation and amortization .......... 42,750 33,767 32,193 25,806 24,297 23,122 17,548 14,882

Stock-based compensation ............. 57,177 54,445 48,354 33,939 27,572 26,798 19,323 12,626

Adjusted EBITDA ................... $111,366 $92,848 $88,642 $83,387 $78,587 $55,956 $50,369 $38,118

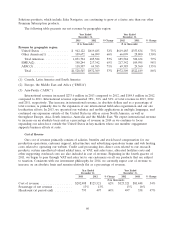

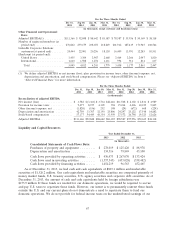

Liquidity and Capital Resources

Year Ended December 31,

2013 2012 2011

(in thousands)

Consolidated Statements of Cash Flows Data:

Purchases of property and equipment ......... $ 278,019 $ 125,420 $ 88,978

Depreciation and amortization .............. 134,516 79,849 43,100

Cash flows provided by operating activities ..... $ 436,473 $ 267,070 $ 133,424

Cash flows used in investing activities ......... (1,357,545) (433,028) (338,482)

Cash flows provided by financing activities ...... 1,454,219 96,563 452,465

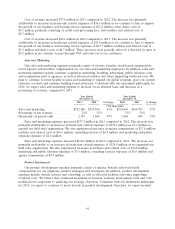

As of December 31, 2013, we had cash and cash equivalents of $803.1 million and marketable

securities of $1,526.2 million. Our cash equivalents and marketable securities are comprised primarily of

money market funds, U.S. treasury securities, U.S. agency securities and corporate debt securities. As of

December 31, 2013, the amount of cash and cash equivalents held by foreign subsidiaries was

$153.9 million. If these funds are needed for our domestic operations, we would be required to accrue

and pay U.S. taxes to repatriate these funds. However, our intent is to permanently reinvest these funds

outside the U.S. and our current plans do not demonstrate a need to repatriate them to fund our

domestic operations. We do not provide for federal income taxes on the undistributed earnings of our

67