LG 2003 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2003 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96

Notes to Non-Consolidated Financial Statements

For the years ended December 31, 2003 and 2002

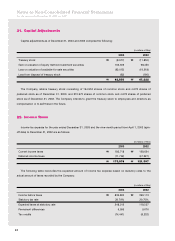

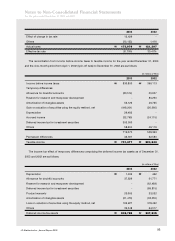

The Company periodically assesses its ability to recover deferred income tax assets. In the event of a significant

uncertainty regarding the Company’s ultimate ability to recover such assets, a valuation allowance is recorded to

reduce the assets to its estimated net realizable value.

The statutory income tax rate, including resident tax surcharges, applicable to the Company was approximately

29.7% in 2003 and 2002, and was amended to 27.5% effective for fiscal years beginning January 1, 2005, in

accordance with the Corporate Income Tax Law enacted in December 2003. Deferred income tax assets were

computed by applying the present tax rate of 29.7% for the temporary differences expected to be realized by 2004,

and by applying the amended tax rate of 27.5% for the temporary differences expected to be realized in fiscal years

beginning January 1, 2005 and thereafter.

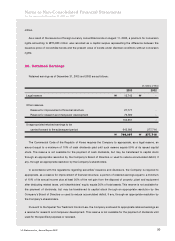

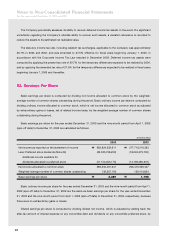

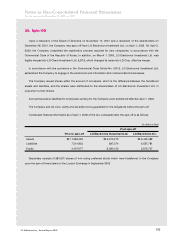

23. Earnings Per Share

Basic earnings per share is computed by dividing net income allocated to common stock by the weighted-

average number of common shares outstanding during the period. Basic ordinary income per share is computed by

dividing ordinary income allocated to common stock, which is net income allocated to common stock as adjusted

by extraordinary gains or losses, net of related income taxes, by the weighted-average number of common shares

outstanding during the period.

Basic earnings per share for the year ended December 31, 2003 and the nine-month period from April 1, 2002

(spin-off date) to December 31, 2002 are calculated as follows:

(in Korean Won)

2003 2002

Net income as reported on the statement of income ₩662,824,222,611 ₩277,716,219,383

Less: Preferred stock dividends (Note 24) (22,335,708,200) (18,040,379,700)

Additional income available for

dividends allocated to preferred stock (51,154,053,170) (13,199,480,276)

Net income allocated to common stock 589,334,461,241 246,476,359,407

Weighted-average number of common shares outstanding 139,357,190 139,414,824

Basic earnings per share ₩4,229 ₩1,768

Basic ordinary income per share for the year ended December 31, 2003 and the nine-month period from April 1,

2002 (spin-off date) to December 31, 2002 are the same as basic earnings per share for the year ended December

31, 2003 and the nine-month period from April 1, 2002 (spin-off date) to December 31, 2002, respectively, because

there were no extraordinary gains or losses.

Diluted earnings per share is computed by dividing diluted net income, which is adjusted by adding back the

after-tax amount of interest expense on any convertible debt and dividends on any convertible preferred stock, by