LG 2003 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2003 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

Notes to Non-Consolidated Financial Statements

For the years ended December 31, 2003 and 2002

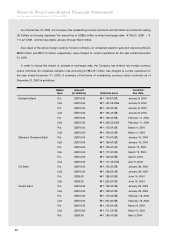

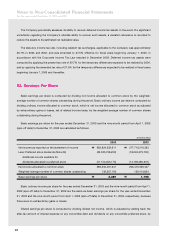

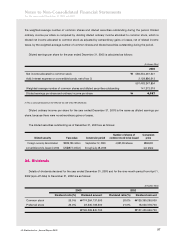

As of December 31, 2003, the Company has outstanding forward contracts with UFJ Bank and others for selling

US Dollars and buying Japanese Yen amounting to US$25 million (contract exchange rates: ¥106.57: US$1 ~ ¥

111.42: US$1, contract due dates: January through March 2004).

As a result of the above foreign currency forward contracts, an unrealized valuation gain and loss amounting to

₩654 million and ₩3,715 million, respectively, were charged to current operations for the year ended December

31, 2003.

In order to reduce the impact of changes in exchange rates, the Company has entered into foreign currency

option contracts. An unrealized valuation loss amounting to ₩4,461 million was charged to current operations for

the year ended December 31, 2003. A summary of the terms of outstanding currency option contracts as of

December 31, 2003 is as follows:

Option Amount Contract

type (in millions) Exercise price due date

Deutsche Bank Put US$10.00 ₩1,150.0/US$ January 8, 2004

Call US$10.00 ₩1,161.25/US$ January 8, 2004

Put US$10.00 ₩1,150.0/US$ January 8, 2004

Call US$10.00 ₩1,165.4/US$ January 8, 2004

Put US$10.00 ₩1,180.0/US$ February 11, 2004

Call US$10.00 ₩1,208.35/US$ February 11, 2004

Put US$10.00 ₩1,175.0/US$ March 4, 2004

Call US$10.00 ₩1,199.0/US$ March 4, 2004

Standard Chartered Bank Put US$10.00 ₩1,170.0/US$ January 19, 2004

Call US$10.00 ₩1,189.6/US$ January 19, 2004

Put US$10.00 ₩1,155.0/US$ March 12, 2004

Call US$10.00 ₩1,177.9/US$ March 12, 2004

Put US$10.00 ₩1,150.0/US$ April 6, 2004

Call US$10.00 ₩1,177.35/US$ April 6, 2004

Citi Bank Put US$10.00 ₩1,150.0/US$ January 28, 2004

Call US$10.00 ₩1,168.0/US$ January 28, 2004

Put US$5.00 ₩1,185.0/US$ June 16, 2004

Call US$5.00 ₩1,222.9/US$ June 16, 2004

KorAm Bank Put US$10.00 ₩1,150.0/US$ January 28, 2004

Call US$10.00 ₩1,168.0/US$ January 28, 2004

Put US$10.00 ₩1,175.0/US$ February 18, 2004

Call US$10.00 ₩1,207.8/US$ February 18, 2004

Put US$10.00 ₩1,150.0/US$ March 9, 2004

Call US$10.00 ₩1,171.5/US$ March 9, 2004

Put US$5.00 ₩1,180.0/US$ May 6, 2004