LG 2003 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2003 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG Electronics Inc._Annual Report 2003 59

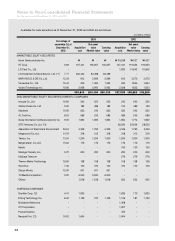

Notes to Non-Consolidated Financial Statements

For the years ended December 31, 2003 and 2002

Accounting Estimates

The preparation of the financial statements requires management to make estimates and assumptions that affect

amounts reported therein. Although these estimates are based on management’s best knowledge of current events

and actions that the Company may undertake in the future, actual results may be different from those estimates.

Application of the Statements of Korean Financial Accounting Standards

The Korean Accounting Standards Board (“KASB”) has published a series of Statements of Korean Financial

Accounting Standards (“SKFAS”), which will gradually replace the existing financial accounting standards

established by the Korean Financial Supervisory Commission. SKFAS No. 1, Accounting Changes and Corrections

of Errors, became effective for the Company on January 1, 2002, and SKFAS No. 2, Interim Financial Reporting,

through No. 9, Convertible Securities, became effective for the Company on January 1, 2003. The Company has

adopted these statements in its financial statements for the year ended December 31, 2003. The most significant

statement for the Company is SKFAS No. 4, Revenue Recognition.

Spin-Off Accounting

Upon a resolution of the shareholders of LG Electronics Investment Ltd. (formerly LG Electronics Inc., now

merged to LG Corp.), on December 28, 2001, the Company was spun off from LG Electronics Investment Ltd. on

April 1, 2002. The significant accounting policies followed by the Company in the spin off are as follows:

*Assets and liabilities are transferred based on the book value.

*Capital adjustments, including the gain or loss on valuation of investment securities, which are directly related

to assets and liabilities transferred to the Company, are also transferred to the Company.

*The difference between the Company’s net assets transferred from LG Electronics Investment Ltd. and capital,

after adjustments arising from capital adjustments, is credited to paid-in capital in excess of par value.

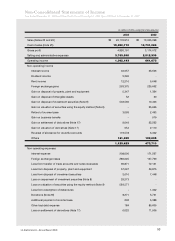

Revenue Recognition

Revenues from finished products and merchandise are recognized when most of the risks and benefits

associated with the possession of goods are substantially transferred. Accordingly, sales of finished products are

recognized when inspection is completed, and sales of merchandise are recognized when delivered. Revenue from

installation service contracts is recognized using the percentage-of-completion method.

Effective as of January 1, 2003, pursuant to Statements of Korean Financial Accounting Standards (“SKFAS”)

No. 4, Revenue Recognition, the Company changed its accounting method for revenue recognition related to certain

sales, from recognizing revenue on a gross basis to recognizing revenue on a net basis. This change resulted in the

decrease in sales and cost of sales for the year ended December 31, 2003 by ₩1,244,262 million each.

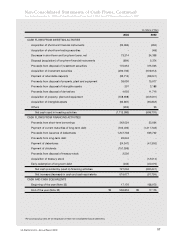

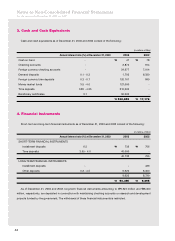

Cash and Cash Equivalents

The Company considers cash on hand, bank deposits and highly liquid marketable securities with original

maturities of three months or less to be cash and cash equivalents.

Securities

The Company accounts for equity and debt securities under the provisions of Statement of Korean Financial