LG 2003 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2003 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

Notes to Non-Consolidated Financial Statements

For the years ended December 31, 2003 and 2002

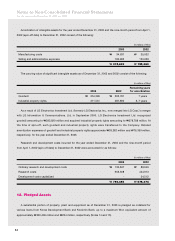

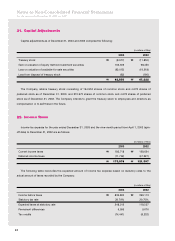

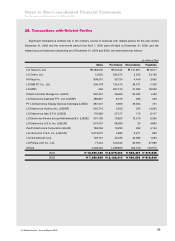

18. Capital Stock

Capital stock as of December 31, 2003 is as follows:

Number of Par value

shares issued per share Millions of Won

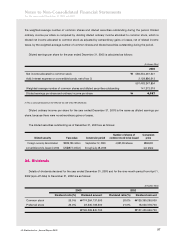

Common stock 139,606,263 ₩5,000 ₩698,031

Preferred stock (*) 17,185,992 5,000 85,930

156,792,255 ₩783,961

As of December 31, 2003 and 2002, the number of shares authorized is 600,000,000 shares.

(*) The preferred shareholders have no voting rights and are entitled to non-participating and non-cumulative preferred dividends at a rate of one

percentage point over those for common stock. This preferred dividend rate is not applicable to stock dividends.

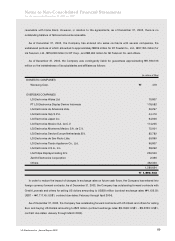

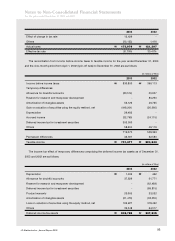

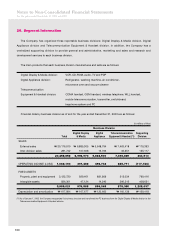

19. Capital Surplus

As a result of the spin-off, on April 1, 2002, ₩1,876,153 million was recorded as capital surplus representing the

difference between net assets transferred from LG Electronics Investment Ltd. of ₩2,815,707 million and capital

stock of ₩783,961 million and capital adjustments transferred from LG Electronics Investment Ltd. of ₩155,593

million were recorded as a non-operating income and expense, respectively, for the year ended December 31,

2003.

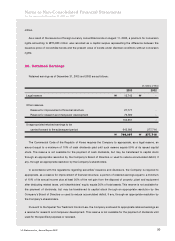

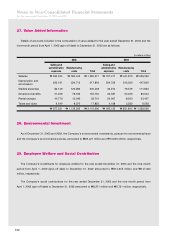

As of December 31, 2003, the Company is named as the defendant in legal actions which were brought against

the Company by AVS Corporation in Canada and Mahmood Saleh Abbar Co. in Saudi Arabia. In addition, the

Company is named as the defendant or the plaintiff in various foreign and domestic legal actions arising from the

normal course of business. The aggregate amounts of domestic claims as the defendant and the plaintiff amounted

to approximately ₩2,931 million in thirteen cases and ₩618 million in three cases, respectively, as of December

31, 2003. The Company believes that the outcome of these matters is uncertain but, in any event, they would not

result in a material ultimate loss for the Company. Accordingly, no provision for potential losses arising from these

claims is reflected in the accompanying non-consolidated financial statements.

In common with certain other Asian countries, the economic environment in the Republic of Korea continues to

be volatile. In addition, the Korean government and the private sector continue to implement structural reforms to

historical business practices, including corporate governance. The Company may be either directly or indirectly

affected by these volatile economic conditions and the reform program described above. The accompanying non-

consolidated financial statements reflect management's assessment of the impact to date of the economic

environment on the financial position and results of operations of the Company. Actual results may differ materially

from management’s current assessment.